Guide for Beginners

-

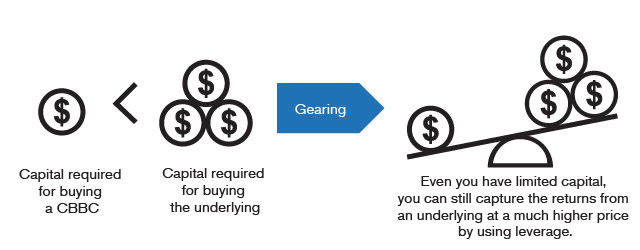

With a small capital outlay, you can track the performance of the entire underlying asset

CBBCs are a type of investment instrument by which the investor can track the trend of a certain asset by investing in only a fraction of the asset’s value. To trade a small amount for a big return like this is known as the gearing effect. In Hong Kong’s CBBC market, underlying assets mainly refer to indices and stocks.

-

Providing options for both optimistic and pessimistic outlooks

CBBCs consist of bulls and bears. As the name suggests, "bull" and "bear" indicate the directions in which the products are deployed, i.e. options for optimistic and pessimistic outlooks. For instance, investors may consider investing in AIA bulls if they are bullish on AIA; if they are bearish on HSI, they may invest in HSI bears.

Set out in the table below are the theoretical impacts of the rise and fall of underlying assets on bulls and bears:

Price of underlying assets Bulls Bears Theoretical price rises Theoretical price drops -

Mandatory call feature

Just like warrants, CBBCs have an exercise price. However, they also have a call price, which reflects a unique feature of CBBCs – that they have a mandatory call feature.

Call price represents the price level at which trading in a CBBC will be immediately suspended once the price of the underlying asset rises or drops to that level, commonly known as “target shooting”. After that, however the underlying price changes, trading in the CBBC will not resume. And the called products simply await settlement.

| Underlying price | Bulls Theoretical price |

Bears Theoretical price |

|---|---|---|

| Increase | Rise |

|

| Decrease | Drop | Rise |