Guide for Beginners

-

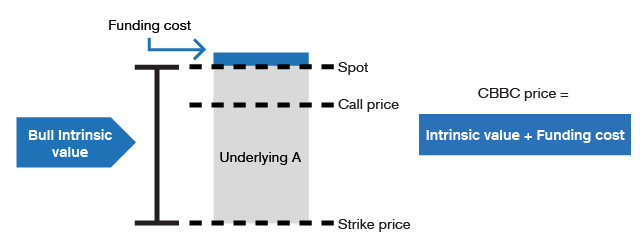

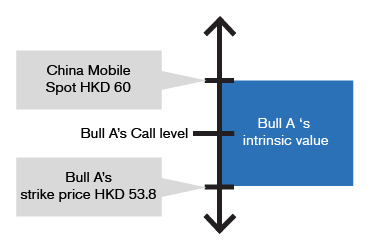

Intrinsic valueAll CBBCs in circulation have an intrinsic value, which is also a major component of a CBBC. Intrinsic value generally refers to the value contained in the product, i.e. the difference between the underlying asset price and the exercise price. The formula to calculate intrinsic value is as follows:Intrinsic value of a bull = (price of underlying asset – exercise price) ÷ entitlement ratioIntrinsic value of a bear = (exercise price –price of underlying asset) ÷ entitlement ratioFor instance, the spot price of China Mobile is $60.

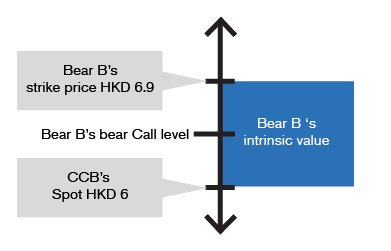

For Bull A with a call price of $55, an exercise price of $53.8 and an entitlement ratio of 100:1, its intrinsic value = (60 – 53.8) ÷ 100 = $0.062As another example, the spot price of CCB is $6.

its intrinsic value = (60 – 53.8) ÷ 100 = $0.062As another example, the spot price of CCB is $6.

For Bear B with a call price of $6.8, an exercise price of $6.9 and an entitlement ratio of 10:1, its intrinsic value = (6.9 – 6) ÷ 10 = $0.090

its intrinsic value = (6.9 – 6) ÷ 10 = $0.090 -

Funding cost

CBBCs’ prices are generally higher than the calculated intrinsic values, mainly because certain funding costs are included.

The sale of CBBCs by issuers is similar in nature to the provision of a margin financing (in the case of bulls) and lending stocks for a short sale (in the case of bears), hence the issuer charges certain funding costs as part of their own costs. Methods to calculate funding cost vary with different borrowing rates used by the issuers.

In general, the longer the tenor of a CBBC, the higher its funding cost will be, with the funding costs reducing gradually as the products approach expiry. Funding cost reaches zero when a CBBC expires or is called back.

-

Premium

The premium of a CBBC can be considered as the actual value of the CBBC’s funding cost collected by the issuer. Actually, such funding cost is not merely the borrowing cost; it also contains the hedging cost charged by issuers, as well as certain ex-dividend factors in the underlying assets before expiry.

Generally speaking, the higher a CBBC’s premium, the higher its funding cost will be. But price comparison only makes sense when it comes to CBBCs with the same terms. A large difference between the expiry dates of two CBBCs means different ex-dividend levels of the underlying assets before expiry, which could result in different premiums of the CBBCs, making it hard to make a direct comparison between them. But all in all, once a CBBC is called back before expiry, investors who hold CBBCs with the same terms but lower premium suffer less loss.

Upon expiry, the funding cost will have been fully deducted and reach zero.

Upon expiry, the funding cost will have been fully deducted and reach zero.