Guide for Beginners

-

Expiry date

Each CBBC has an expiry date. When the product expires, the CBBC that is not called back will be settled and delisted. CBBCs listed in Hong Kong are settled in cash and those with an intrinsic value will receive cash value.

-

Final trading day

As the name suggests, it is the final day on which a CBBC can be traded. After the final trading day, the product will be delisted and awaits settlement. Generally speaking, the final trading day of a CBBC is typically the trading day immediately preceding the expiry date.

-

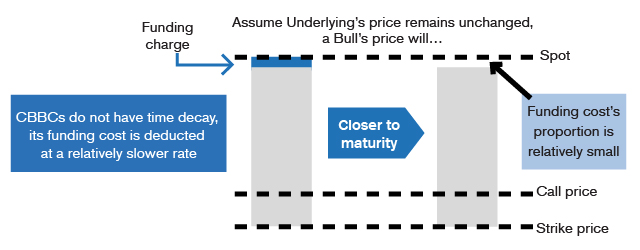

No time decay

Unlike warrants, the value of CBBCs includes the intrinsic value and funding cost but excludes time value. That is to say, CBBCs are not subject to time decay.

Nonetheless, CBBCs incur funding costs. As explained above, the longer a CBBC’s tenor is, the higher its funding cost will be. The issuer will, upon listing, include all the funding costs to be incurred before the product expires into the CBBC price and make daily deductions as time passes.

That said, funding cost takes up only a small part of a CBBC’s price. Even for products with an extremely long tenor, it typically takes up only a few percentage points. As the shortest tenor of a CBBC is 3 months when listed, the daily deduction in funding cost is actually quite small.