Guide for Beginners

-

Calculation of the sensitivity of stock CBBCs

Although CBBCs also have a delta, the delta is, more often than not, excluded in calculating the sensitivity of CBBCs since it is usually close to 1. For stock CBBCs, the formula is as follows:

Sensitivity of a stock CBBC =minimum spread of underlying asset

entitlement ratio x minimum spread of CBBCsFor example, assume that the spot price of HSBC is $65 and the spot price of a HSBC bull with an entitlement ratio of 100:1 is $0.060. Its sensitivity =

0.05

100 x 0.001= 0.5That is, the bull's price will move by 0.5 ticks for every tick ($0.05) HSBC moves, assuming other factors remain unchanged. Yet since CBBC prices cannot move by half a tick, the sensitivity shall be that the bull moves by1 tick ($0.001) theoretically for every 2 ticks ($0.1) HSBC moves by.

-

Calculation of the sensitivity of index CBBCs

Sensitivity of an index CBBC =

entitlement ratio x minimum spread of the CBBC

For example, for a bull with an entitlement ratio of 10,000:1 and a spot price under $0.25, its sensitivity =

10000 x 0.001 = 10

That is, the bull's price will move by 1 tick ($0.001) for every 10 ticks the index future moves by, assuming other factors remain unchanged. Put more simply, theoretical sensitivity of a CBBC with an entitlement ratio of 12,000:1 is 1 tick for every 12 ticks the index future moves by; theoretical sensitivity of a CBBC with an entitlement ratio of 20,000:1 is 1 tick for every 20 ticks the index future moves by.

However, index CBBCs have more changeable tenors and are subject to ex-dividend factors. Most long-tenor bulls in the market have a delta below 1, while short-dated bears have a delta generally above 1. Therefore, the calculation of the sensitivity of CBBCs in practice may differ slightly from what is stated above. Details about how delta affects the sensitivity of a CBBC are set out in the Guide for the More Experienced: Terms of CBBCs Drill-down (I) Delta.

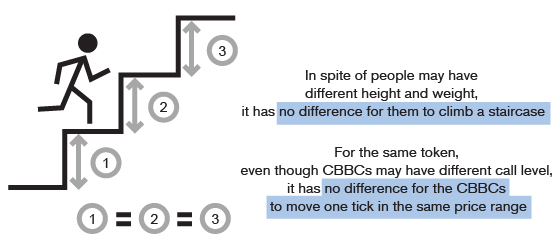

Bull A and Bull B share the same sensitivity, because they have the same entitlement ratio and minimum spread.

Bull A and Bull B share the same sensitivity, because they have the same entitlement ratio and minimum spread.