Guide for Beginners

-

When a CBBC is called back...

Once the underlying asset price reaches the call price of a CBBC, trading in the CBBC will be suspended immediately and called back mandatorily for settlement. When a CBBC is called back, the maximum loss is the whole invested principal but the investor stands a chance to receive a small amount of residual value after calculation.

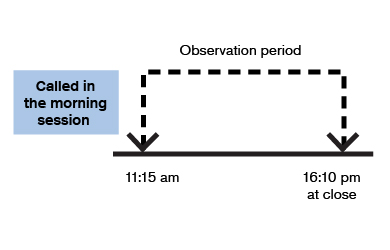

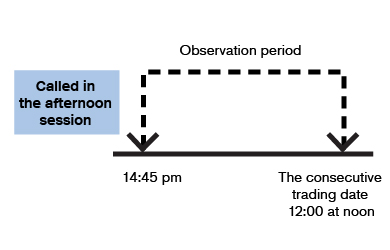

A typical trading day comprises two full trading sessions, i.e. morning session and afternoon session. Normally, maximum and minimum prices during the two full trading sessions after a CBBC is called back will be observed, so as to confirm whether they have risen above or dropped below exercise price; and when a product is called back, its maximum and minimum prices during the trading session in which the call event occurs and the session immediately following will be observed. Such prices will be used as the settlement price of the CBBC.

For example, if a bull is called back at 11:15 am, the minimum prices of the underlying asset both in the morning and the afternoon sessions of that same day shall be observed to see whether they have dropped below the exercise price. If the minimum prices during the periods have once dropped below exercise price, the residual value will be zero. If the minimum prices during the periods have never dropped below the exercise price, the minimum price will be taken as the settlement price.

Another example: if a bear is called back at 2:45 pm, the maximum prices of the underlying asset in the afternoon of the same day and in the morning of the next trading day shall be observed to see whether they have risen above the exercise price. If the maximum prices during the periods have once risen above the exercise price, the residual value will be zero. If the maximum prices during the periods have never risen above exercise price, the maximum price will be regarded as the settlement price.

-

Calculation of residual value

When the settlement price of a CBBC is available, the residual value can be calculated with this figure, using the following formula:

Residual value of a bull = (settlement price of the bull - exercise price) ÷ entitlement ratio

Residual value of a bear = (exercise price - settlement price of the bear) ÷ entitlement ratioFor instance, an HSI bull has a call price of 25,000 points, an exercise price of 24,900 points and an entitlement ratio of 10,000:1. As observed, the minimum price during the two trading sessions including the one in which the call event occurred is 24,938 points.

Residual value of this bull = (24,938 - 24,900) ÷ 10,000 = 0.0038.

That is, the recoverable residual value per share is $0.0038.

Another example: assume a Tencent bear has a call price of $345, an exercise price of $347.8 and an entitlement ratio of 500:1. As observed, the maximum price during the two trading sessions including the one in which the call event occurred is $346.6.

Residual value of this bear = (347.8 - 346.6) ÷ 500 = 0.0024.

That is, the recoverable residual value per share is $0.0024.

After a CBBC is settled, the issuer will transfer the amount of residual value to CCASS within around 3 trading days. The value will then get deposited into each investor’s account via banks or securities companies. In general, investors will receive the residual value within 5 trading days after settlement and the issuer will not charge any fees.

| Call price | Exercise price | Settlement price | Entitlement ratio | |

|---|---|---|---|---|

| 1. HSI bull | 26,588 points | 26,488 points | 26,236 points | 12000 |

| 2. HSCEI bear | 10,238 points | 10,338 points | 10,301 points | 10000 |

| 3. HSBC bull | $62.68 | $61.68 | $61.85 | 100 |

| 4. HKEx bear | $238.38 | $240.38 | $242.2 | 500 |

Residual value of the HSCEI bear = (10,338 – 10,301) ÷ 10000 = $0.0037.

Residual value of the HSBC bull = (61.85 – 61.68) ÷ 100 = $0.0017.

Settlement price of the HKEx bear is higher than exercise price, which means the residual value is zero.

Residual value of the HSCEI bear = (10,338 – 10,301) ÷ 10000 = $0.0037.

Residual value of the HSBC bull = (61.85 – 61.68) ÷ 100 = $0.0017.

Settlement price of the HKEx bear is higher than exercise price, which means the residual value is zero.