Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for the More Experienced

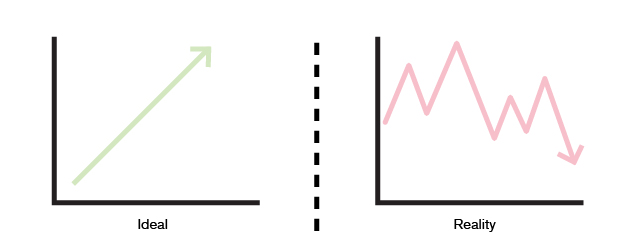

An investor certainly hopes the stock price can rise after he buys, but the reality may be that the price fluctuates up and down...

-

Reasons for hedging against risksAfter an investor buys a stock, he certainly hopes the stock price can rise continuously. But in reality, there may be a decrease in the price of any share. Therefore, the need to hedge against risks should also be taken into account in asset allocation and portfolio.Like a warrant (see Warrant.Guide for the More Experienced: Hedging against Risks for details), CBBCs can also be used for hedging against risks. After buying stocks, an investor may consider buying CBBCs as a hedge if he is concerned about the possibility of a fall in the stock price. If the stock price rises as the investor expects, since the theoretical price of a bear is the difference between the exercise price and the spot price, the maximum loss is limited to the entire principal. However, if contrary to expectations the stock price drops, the price of the bear which features leverage rises, which can partially offset the loss caused by the drop in stock price, thus helping to reduce the loss of the whole investment portfolio.

-

Methods for risk hedgingIf an investor wants to use bears for hedging, how many bears should he buy to hedge for the underlying assets he holds? The formula is as follows:The number of bears to be purchased = number of underlying assets x entitlement ratio of CBBCFor example, say an investor holds 1,000 Ping An shares, and he wants to hedge for the whole investment. Using a 100:1 Ping An bear for hedging, the number of bears to be purchased is:1,000 x 100 = 100,000 sharesNote that when using bears to hedge for all the stockss held, in theory, the whole investment portfolio may not make a profit when the stock price goes down, because the profit and loss from the stocks and from the bears will offset against each other. However, in practice, investors will still need to take a view on the future direction of the market, whether optimistic or pessimistic, and use bears as a hedge for part of theportfolio, in order to reduce the risk of taking an incorrect view of the market.

Consolidate your memory immediately!

After selling 1200 HSBC shares,

if you want to use a 100:1 bear B to hedge against risks, you need to buy

bears.

Since there is a high volatility in the stock price, should an investor pay special attention to the call price when selecting a CBBC?

Equivalent to Borrowing Money from an Issuer

Locking in Profit

Volatility of Underlying Asset Affects the Selection of a CBBC

Complementation of a CBBC's Outstanding Quantity and Money Flow

Correct!

The number of bears to be purchased = number of underlying assets x entitlement ratio of CBBC, that is, 1200 x 100 = 120,000.

Wrong!

The number of bears to be purchased = number of underlying assets x entitlement ratio of CBBC, that is, 1200 x 100 = 120,000.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.