When the stock price fluctuates, the possibility of the underlying asset's price rising or falling to the call price increases.

The issuer will allow for more buffers for CBBCs, so their premium is also higher.

Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for the More Experienced

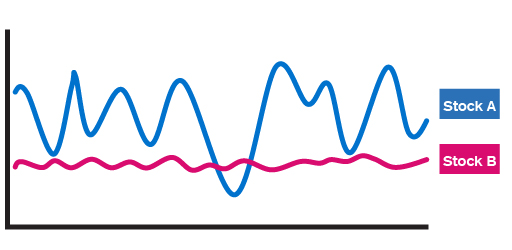

Some stocks tend to have big ups and downs, while the trend of other stocks is almost a line...

-

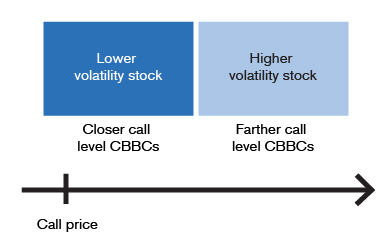

The volatility of the underlying asset affects the risk of a mandatory call eventIn the market, there are always some stocks that are more volatile, such as gambling stocks or mobile device stocks; while some stocks tend to be less volatile, such as heavyweight stocks including HSBC (0005) and CHINA MOBILE (0941). Investors may be familiar with this. Moreover, the historical volatility of stock price may also affect the strategy of selecting a CBBC to some extent.If the stock price is less volatile and the intraday volatility is only 1% to 2%, the possibility of a CBBC being called back is relatively low due to limited movement in stock price. Therefore, investors may prefer to choose a product whose call price is closer to the spot price. Moreover, the gearing of a product close to its call level is also relatively high, helping to magnify the narrower movement in the underlying asset price.On the other hand, if the volatility of the stock price is relatively high and the intraday volatility is often 4% to 5%, investors may prefer to choose a product whose call price is further to the spot price, since the possibility of a CBBC being called back is relatively high. Though the gearing of a product with further call level is relatively low, notable magnifying effects can also be obtained if the stock price is volatile enough.

-

A warrant's implied volatility reflects the volatility in the stock priceInvestors may ask how to know the historical volatility in the stock price. For investors who have always been paying attention to the stock market, they may have some understanding of the volatility of their favorite stocks; if they want to obtain more specific data, the degree of the warrant’s implied volatility may be used for reference to a certain extent.Let’s review Warrant.Guide for Beginners: Understanding Warrant Terms One by One (V) - Implied Volatility. Implied volatility refers to the market's prediction of the future volatility of underlying assets, and the prediction is mainly refer to the historical performance of the underlying assets.For some stocks with less volatility, such as HSBC (0005), the implied volatility of active warrants linked to them is generally as low as 20%, reflecting that the relatively low volatility in stock price. To the contrary, the implied volatility of active warrants of mobile device stocks such as SUNNY OPTICAL (2382) and AAC TECH (2018) is as high as 60%, reflecting that the stock price is usually more volatile. Investors may refer to the implied volatility of the warrants to infer the historical volatility of the stock price, which can be used as a reference in the selection of the CBBC call price.The historical volatility of different assets and the average implied volatility of the relevant warrants are shown on the Implied Volatility and Comparison page of this website, for investors’ easy reference when formulating investment strategies.

-

Relationship between volatility and CBBC premiumInvestors familiar with warrants may ask, since the implied volatility of warrants related to volatile stocks is high, which has increased investment cost in disguised form; while CBBCs do not have the implied volatility, its theoretical price is the difference between the spot price and exercise price; does it mean that CBBCs are more “worth buying” than warrants if an investor wants to invest in stocks with high volatility? Though CBBCs of such stocks have a higher risk of a mandatory call event, can such risk be reduced if the product with further call level is selected?In practice, however, this is not entirely true, since the value of a CBBC includes funding cost in addition to intrinsic value. In Guide for the More Experienced: CBBC Terms Drill-down (III) Funding Cost, it has been explained that for volatile stocks, the issuer may measure the possibility of a gap and take into account additional funding cost in the CBBC price, which will be reflected in the premium.By observing the CBBCs of CHINA MOBILE (0941) and mainland bank stocks, we can find out that their premium is generally within 1% (long-term CBBCs include more dividends, and the negative premium of a bull or the high premium of a bear is only affected by dividends. Please refer to Guide for the More Experienced: CBBC Terms Drill-down (II) Relationship Between Premium and Dividend for details).As for the CBBCs of mobile device stocks or MEITUAN (3690) and other “New Economy” stocks, the premium is generally 2% to 3% or even higher, which is the buffer built in by the issuer in response to the volatility in stock price.

Consolidate your memory immediately!

1. The premium of CBBCs of stocks with a higher volatility is generally higher

2. When the stock price fluctuates, the CBBC’s s risk of a mandatory call event is relatively higher

3. CBBCs with further call level have a lower risk of a mandatory call event, but this does not mean that they will not be called back

2. When the stock price fluctuates, the CBBC’s s risk of a mandatory call event is relatively higher

3. CBBCs with further call level have a lower risk of a mandatory call event, but this does not mean that they will not be called back

Which of the above is correct?

Why does the outstanding quantity increase when there is a money outflow recorded for bulls?

Equivalent to Borrowing Money from an Issuer

Locking in Profit

Hedging against Risks

Complementation of a CBBC's Outstanding Quantity and Money Flow

Correct!

Wrong!

When the stock price fluctuates, the possibility of the underlying asset's price rising or falling to the call price increases.

The issuer will allow for more buffers for CBBCs, so their premium is also higher.

The issuer will allow for more buffers for CBBCs, so their premium is also higher.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.