Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for the More Experienced

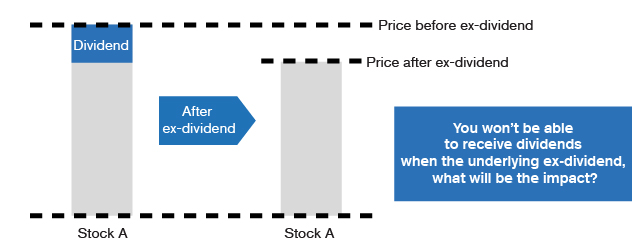

Once stocks are subject to an ex-dividend event, the stock price will be adjusted downwards.

But there are no dividends for a CBBC, so how is the ex-dividend effect reflected?

But there are no dividends for a CBBC, so how is the ex-dividend effect reflected?

-

Intrinsic value is affected after an ex-dividend eventThe Guide for Beginners: How is the CBBC price determined? has explained that the value of a CBBC largely depends on its intrinsic value, which is the difference between the underlying asset's spot price and exercise price. After the dividend is paid, the stock price will decrease. Does it not mean that the intrinsic value of the stock CBBC will also change? When HSI constituent stocks pay dividends and the ex-dividend effect will be reflected in the futures index level in the relevant month. Does it not mean that the intrinsic value of an HSI CBBC will also be affected?Correct! Like warrants, although the holders of CBBCs will not receive dividends, when the issuer issues the CBBC, the CBBC’s price has already taken into account the impact of dividends based on the stock’s dividend distribution record and market expectations. Therefore, it is not difficult for investors to find that the market trading price of some bulls is even lower than the intrinsic value calculated using the spot price, whereas the market trading price of some bears is much higher than the intrinsic value calculated using the spot price, as the dividend factor has been reflected.

-

Positive and negative premiums are only due to an ex-dividend event?The Guide for Beginners: How is the CBBC price determined? has briefly explained that the premium of a CBBC is an indicator used to compare the prices of CBBCs with similar terms. In fact, the real meaning of premium is that, based on the CBBC price at this time, how much does the price of the underlying assets need to increase or decrease to enable you to break even if you purchase the product at this time and hold it till maturity. Since CBBCs have an intrinsic value, the premium is generally only a few percentage points to reflect the financial borrowing costs and hedging costs during the period.Some investors may find that there is a negative premium for some CBBCs. Does it mean that an investor can purchase the product at a discounted price now and earn the amount of discount at maturity even if there is no movement in the underlying asset? In fact, this is just an innocent misunderstanding which stems from the fact that the underlying asset will be ex-dividend.As mentioned above, the issuer has already taken into account the dividend in the CBBC’s price, but the stock may still not be ex-dividend at that time. Since the spot price of the underlying asset is used when the ticker is calculating the product's premium, certain bulls may have a negative premium, while certain bears may have a higher positive premium. This creates the illusion that "a bull is worth buying while a bear is not worth buying". However, once the stocks have been subject to an ex-dividend event and the stock price of the underlying asset adjusted downwards, the premium of the CBBC will return to normal, so in practice, investors will not get extra profits by buying a CBBC with a negative premium.

Consolidate your memory immediately!

Say a bull has a negative premium.

1. Since the bull is "worth buying", an investor can still profit at the discount amount even though the stock price remains unchanged

2. The ticker calculates the premium using the spot price of the stock, but the bull has reflected the ex-dividend factor

3. After an ex-dividend event, the premium will return to normal, so the investor that buys the product at a negative premium will not earn extra profits

1. Since the bull is "worth buying", an investor can still profit at the discount amount even though the stock price remains unchanged

2. The ticker calculates the premium using the spot price of the stock, but the bull has reflected the ex-dividend factor

3. After an ex-dividend event, the premium will return to normal, so the investor that buys the product at a negative premium will not earn extra profits

Which of the above is correct?

Correct!

The negative premium of a bull is generally due to the dividend factor. The premium will return to normal after the ex-dividend event, and the investor will not earn the discount.

Wrong!

The negative premium of a bull is generally due to the dividend factor. The premium will return to normal after the ex-dividend event, and the investor will not earn the discount.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.