As the CBBC is equivalent to the financing or asset lending from the issuer, there is a hedging cost, which is incorporated into the funding cost.

Since the interest rate of borrowing assets is generally higher than that for borrowing funds, the funding cost of a bear is higher than that of a bull.

Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for the More Experienced

Funding cost is deducted daily for a CBBC. Isn’t this the same as time decay in warrants?

-

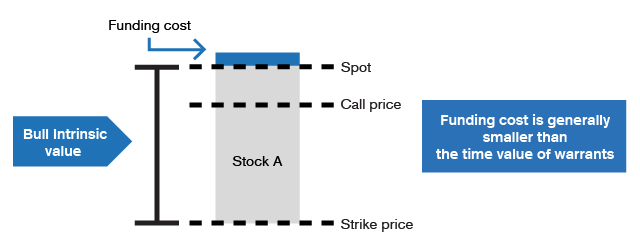

Deduction of funding costThe Guide for Beginners: How is the CBBC price determined? has explained that, in addition to the intrinsic value, the CBBC price also includes certain funding costs.The sale of CBBCs by issuers is similar in nature to the provision of a margin facility (in the case of bulls) and lending stocks for a short sale (in the case of bears), hence the issuer charges certain funding costs for hedging against their own costs. Methods to calculate funding cost vary with different borrowing rates used by the issuers.In practice, since the issuer cannot collect the funding cost from investors holding the CBBCs on a daily basis during the holding period, the issuer will first take into account all the funding cost up until the expiry date when calculating the CBBC price, and then gradually deduct it over time. If an investor sells a CBBC before expiry, he can recover the un-deducted funding cost from the issuer.Some investors may compare the deduction of funding cost for a CBBC with the time decay of a warrant. However, the two are not the same concept. In addition, the funding cost of a CBBC only accounts for a very small part of the price, while time decay accounts for a large part of the value of a warrant, and even the total value of an out-of-the-money warrant. The impact of the deduction of time decay on the price of a warrant is much more apparent than the impact of the deduction of funding cost on a CBBC.“When Issuers sold CBBCs, it is very similar to provide margin financing services (Bulls), or Stock lending for short selling. Issuer will charge a funding cost on the product as the fee for the compensating the hedging cost.”

-

Relationship between funding cost and asset and tenorThe funding cost of a CBBC depends mainly on the underlying asset and the tenor.For assets such as the HSI CBBCs which are traded very actively and have a relatively low cost of trading and borrowing, the premium of the relevant CBBCs will also be lower.However, for some second and third tier stocks which are less active and have a higher cost of borrowing, or some stocks with a high volatility, the issuer will build in more buffers after measuring the possibility of gaps, so the funding cost is also higher; examples are stocks in the gambling and mobile device sectors.Moreover, the funding cost of a CBBC with a longer tenor is also higher since it involves a longer period of borrowing or stock borrowing, which increases the issuer’s cost.

-

Is the funding cost of a bear higher?The nature of a bull is similar to the provision of margin financing; that is, the issuer is lending money to the investor to buy the stocks. The investor can benefit from the movement of the asset at a low cost. The cost saved by the investor is equivalent to the financing provided by the issuer.The nature of a bear is similar to short-selling; that is, the issuer is lending assets to the investor for short-selling in advance. After the asset price falls, the investor then buys the assets to close the trade, thereby earning the price difference. So this is equivalent to the issuer lending the assets. Since there is a cost for financing and asset lending, the issuer needs to collect the funding cost.The cost of stock borrowing is generally higher than the cost of funding, so even for a bull and a bear with similar underlying assets and similar tenors, the funding cost of the bear will be higher than that of the bull.

Consolidate your memory immediately!

The funding cost of a CBBC

1. is the same as the hedging cost of the issuer

2. will be fully reflected in the price and then deducted gradually

3. of a bear is higher than that of a bull, since borrowing of assets is generally more expensive than borrowing of funds

1. is the same as the hedging cost of the issuer

2. will be fully reflected in the price and then deducted gradually

3. of a bear is higher than that of a bull, since borrowing of assets is generally more expensive than borrowing of funds

Which of the above is correct?

Do the movement of the prices of the underlying asset and CBBC affect the sensitivity of the CBBC?

(1) Delta

(2) Relationship Between Premium and Dividend

Correct!

Wrong!

As the CBBC is equivalent to the financing or asset lending from the issuer, there is a hedging cost, which is incorporated into the funding cost.

Since the interest rate of borrowing assets is generally higher than that for borrowing funds, the funding cost of a bear is higher than that of a bull.

Since the interest rate of borrowing assets is generally higher than that for borrowing funds, the funding cost of a bear is higher than that of a bull.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.