When the bull price rises above $0.25, the minimum spread of the bull will be $0.05,

its sensitivity is = 10000 x 0.005 = 50; that is, when the futures index moves by 50 points, the bull price will theoretically move by 1 tick.

Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for the More Experienced

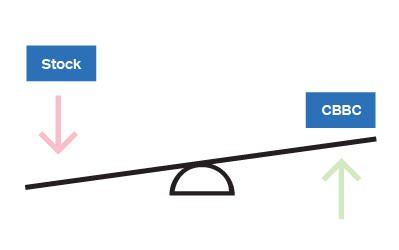

Is it the case that the heavier the object that falls on one end of the lever, the higher the object at the other end will jump?

-

Minimum spreadIn Warrant.Guide for the More Experienced: Different Stock Prices, Different Minimum Spreads, we have explained "minimum spread"; that is, under the rules of the stock exchange, when listed securities are in different price ranges, the minimum spreads for movements are also different, detailed as follows:

Security

price

($)Minimum

spreadFrom 0.01 to 0.25 0.001 Above 0.25 to 0.50 0.005 Above 0.50 to 10 0.010 Above 10 to 20 0.02 Above 20 to 100 0.05 Above 100 to 200 0.10 Above 200 to 500 0.20 Above 500 to 1,000 0.50 Above 1,000 to 2,000 1.0 Above 2,000 to 5,000 2.0 Above 5,000 to 9,995 5.0 Since the formula for calculating the movement sensitivity of a CBBC also takes into account the minimum spread, the sensitivity of a CBBC will also be affected if there is a change in its minimum spread due to the movement of the price of the underlying asset or CBBC. -

When the price of the underlying assets increases by 1 tick...Since each unit of movement in the futures index is "1 point", its minimum spread will not change; however, for stock CBBCs, if the price of the underlying assets increases or drops to a different range, the sensitivity of the relevant CBBCs will also be different.Stock CBBC sensitivity =minimum spread of underlying assets x delta

entitlement ratio x minimum spread of CBBCTaking a 50:1 bull of China Life Insurance as an example, say its delta is 1 and spot price is $0.06, when the price of China Life Insurance is less than $20, and the minimum spread of the underlying assets is $0.02, its sensitivity is =0.02 x 1

50 x 0.001= 0.4That is, when the price of China Life Insurance moves by 1 tick ($0.02), it is insufficient to drive the bull price to move by 1 tick; only when the price of the underlying asset moves by 3 ticks ($0.06) can the bull price move by 1 tick ($0.001).However, when the price of China Life Insurance is above $20, the minimum spread of the underlying asset is changed to $0.05, its sensitivity is =0.05 x 1

50 x 0.001= 1That is, when the price of China Life Insurance moves by 1 tick ($0.05), the bull price will move by 1 tick ($0.001). The CBBC’s sensitivity has increased significantly with the increase in the minimum spread of the underlying asset. -

When the CBBC increases by 1 tick...In addition to the stock price, when CBBCs are in different ranges, their minimum spreads will be different and the sensitivities of the relevant CBBCs will also be different. The influence is most noticeable impact can be seen in an HSI CBBC. Let's review the formula for calculating its sensitivity:The sensitivity of an index CBBC =entitlement ratio x minimum spread of CBBC

deltaSay a bull has a delta of 1, an entitlement ratio of 10,000:1 and the price below $0.25; when the futures index moves by 10 points, the bull price will theoretically move by 1 tick ($0.001).However, when the product becomes further from its call level, and the bull price rises above $0.25, its sensitivity will become 10000 x 0.005 = 50; that is, when the futures index moves by 50 points, the bull price will theoretically only move by 1 tick ($0.005)! No wonder CBBCs with further call levels have always been rather unpopular!As for a stock CBBC, again say the delta is 1, the spot price of Xiaomi is $10.2, and the spot price of a 10:1 Xiaomi bull is $0.240. When the minimum spreads of the underlying asset and bull are $0.02 and $0.001 respectively, its sensitivity is =0.02 x 1

10 x 0.001= 2That is, when Xiaomi's stock price moves by 1 tick ($0.02), assuming all other factors remain unchanged, the bull price will move by 2 ticks ($0.002).However, when the bull price rises to $0.26, the minimum spread of the bull will be changed to $0.005, its sensitivity is =0.02 x 1

10 x 0.005= 0.4That is, when the stock price of Xiaomi moves by 3 ticks ($0.06), the bull price will only move by 1 tick ($0.005). The bull's sensitivity has dropped significantly with the increase in the minimum spread of the bull price. It also explains why CBBCs priced below $0.25 are generally more popular with investors.

Consolidate your memory immediately!

Say the delta is 1, and an HSI bull has an entitlement ratio of 10000: 1,

when the bull price is $0.062, its sensitivity is such that when the futures index moves by 10 points, its price will move by 1 tick,

when the bull price is $0.265, its sensitivity is such that when

For two bulls with the same movement sensitivity, why do they have different leverage?

Difference Between Leverage and Sensitivity

Dividend Amount and Ex-dividend Date are Different from Expectations

Comparison of Bid-ask Spreads

Correct!

Wrong!

When the bull price rises above $0.25, the minimum spread of the bull will be $0.05,

its sensitivity is = 10000 x 0.005 = 50; that is, when the futures index moves by 50 points, the bull price will theoretically move by 1 tick.

its sensitivity is = 10000 x 0.005 = 50; that is, when the futures index moves by 50 points, the bull price will theoretically move by 1 tick.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.