Guide for the More Experienced

-

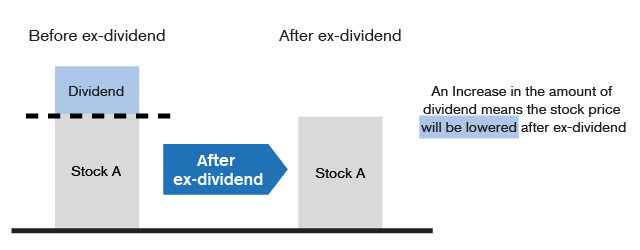

When the dividend distribution is not in line with expectationsLet’s review the introduction in Warrant.Guide for the More Experienced: Impact of Dividends on Warrants. When an issuer issues a warrant, the warrant price has already taken into account the impact of dividends based on the stock’s dividend distribution record and market expectations; actually, the issuer also has the same considerations when issuing CBBCs. Therefore, if the stock has a stable dividend distribution policy and the distributed dividend is in line with expectations, in theory it will not have any impact on the CBBC price.However, a company may adjust its dividend distribution policy as appropriate. If the interim dividend or final dividend is different from market expectations, the CBBC price will be affected.If a company increases the dividend to a level higher than the market's expectations, the ex-dividend price of the stock will be lower than expected, and if the expiry date of the CBBC is after the ex-dividend date, a bull will be subject to a negative impact, while a bear will benefit.When a company unexpectedly reduces its dividend, the ex-dividend price of the stock will be higher than expected, and if the expiry date of the CBBC is after the ex-dividend date, a bull will be affected positively, while the price of a bear will drop.

Dividend distribution of a company Bulls Bears More than expected Drop Rise Less than expected Rise Drop It is worth noting that the relevant impact will be reflected immediately in the trading session following the date when the company declares a dividend distribution, and not having to wait until the ex-dividend date. -

Special dividends

Let’s review the introduction in Warrant.Guide for the More Experienced: Impact of Dividends on Warrants. When a company distributes special dividend, there may be an opportunity for the warrant price to be adjusted, and the relevant adjustment method is also applicable to CBBCs:

If

1.the payout amount of

the special dividend is more than

> 2% of the price of the underlying

asset on the date of declaration,the issuer will adjust the terms (such as the call price, exercise price and entitlement ratio)

according to the dividend distribution ratio.

The precondition for the adjustment is that investors will not suffer a loss due to the change of terms. Therefore,

in theory, the CBBC price will not be affected.2.the payout amount of

the special dividend is less than

< 2%of the price of the underlying

asset on the date of declaration,the CBBC's terms will not be adjusted. Because the ex-dividend stock price will be reduced,

The price of a bull will be negatively affected, while a bear will benefit.

The relevant impact will be reflected immediately in the trading session following the company’s declaration of dividend distribution,

similar to the situation when the dividend amount is more than expected. -

When the dividend distribution date is not in line with expectations

Let’s review the introduction in Warrant.Guide for the More Experienced: When the Ex-dividend Date Is Changed. When an issuer issues a warrant, it has reflected the dividend distribution factor in the warrant price according to the stock's past dividend distribution records and the expiry date of the product. The issuer’s practice in the issuance of CBBCs is also similar. Therefore, if the stock's ex-dividend date is in line with expectations, in theory, the CBBC price will not be affected.

If a company changes its dividend policy, such as bringing forward or postponing the ex-dividend date, it is possible that the CBBC price will +-9 brings forward the ex-dividend date, for CBBCs which would have expired before the old ex-dividend date, because the ex-dividend date is now brought forward to a date before the expiry date, the price of the underlying assets will be reduced ahead of schedule,

As result, a bull will be subject to a negative impact, while a bear will benefit.

If a company postpones the ex-dividend event to a date after the expiry date of a CBBC, the price of the underlying assets will only be reduced after the expiry date.

As result, a bull will be positively affected, while the price of a bear will drop.

Ex-dividend event of a company Bulls Bears Brought forward to a date before the expiry date Drop Rise Postponed to a date after the expiry date Rise Drop Note that even when a company brings forward or postpones the dividend distribution, if the expiry date of the CBBC comes after the ex-dividend dates before and after the change, in theory, the CBBC price will not be affected.

2. When the price of the underlying asset is $5 and the special dividend is 20 cents, the CBBC terms will be adjusted

3. When a company postpones the ex-dividend event from May to June, the price of the bull that expires in August will not be affected

The product's price will be affected only if the company postpones the ex-dividend event to a date after the expiry date of the CBBC.

The product's price will be affected only if the company postpones the ex-dividend event to a date after the expiry date of the CBBC.