Guide for the More Experienced

-

Review of bid-ask spreadIn Warrant.Guide for the More Experienced: Comparison of Bid-ask Spreads, we have explained the warrant's bid-ask spread and “best bid-ask spread”. Such theory also applies to CBBCs.When an issuer provides liquidity for CBBCs, it will offer appropriate bid prices and ask prices according to the underlying asset's liquidity, turnover, product sensitivity, difficulty in hedging and other factors. The difference between the maximum bid price and minimum ask price offered by the issuer is the bid-ask spread. The price difference between those two trades is the trading cost of the investor.It is not the case that the existence of “discount price” means an unreasonable bid-ask spread has been offered by the issuer, because the sensitivity of a CBBC varies from clause to clause. The concept of “best bid-ask spread” allows investors to measure whether the quote offered by the issuer is reasonable through observing the sensitivity. If a CBBC has such a sensitivity that the CBBC price will move by 2 ticks in theory when the price of the underlying assets moves by 1 tick, its “best bid-ask spread” should also be 2 ticks. If the issuer can offer a spread of 1 to 3 ticks for the product, that should be considered as a reasonable quote.“ The difference between an issuer’s best bid and ask price is called “spread”. Investors should aware that this is the intrinsic cost for every transaction. ”

-

Spread = Trading Cost

Of course, the investor expects that the spread offered by the issuer be as narrow as possible since a narrow spread can reduce the trading cost. For example, in the event that an issuer offers a bid & ask order of 0.062/0.063 for a CBBC, if the investor buys at the spot price of $0.063 and sells at the price of $0.062, the spread of $0.001 between these two prices is the investor's trading cost for such deployment, while the spread of $0.001 is already the minimum spread in the main board trading system.

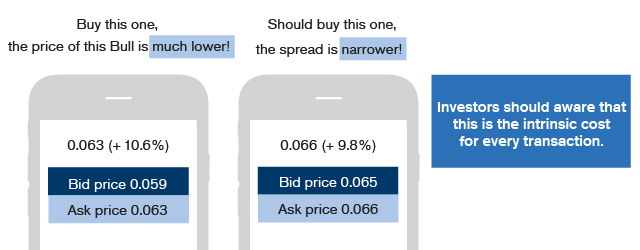

A lot of investors only compare the nominal price or spot price and ignore the bid-ask spread when comparing CBBCs. However, the amount of the spread can substantially increase the trading cost at any time. Try to compare the following two CBBCs:

Which one is more worth buying?Bid price Ask price Bull A 0.059 0.063 Bull B 0.065 0.066 Investors may consider bull A more “worth buying” because it has a lower price. However, in fact, assuming all other factors remain unchanged, when the investor buys bull A at the price of $0.063, he can only sell the product at the price of $0.059 on the same day. The trading cost (the 4-tick bid-ask spread) is equal to approximately 6% of the invested principal (0.004 ÷ 0.063 = 6.3%).Though the price of bull B is higher, its bid-ask spread is only 1 tick and its trading cost is less than 2% of its principal (0.001 ÷ 0.066 = 1.5%). Thus, in practice, it is more “worth buying” than bull A.

| Bid price | Ask price | |

|---|---|---|

| Bull A | 0.110 | 0.112 |

| Bull B | 0.104 | 0.108 |