Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for the More Experienced

The investor only needs to pay the cost between the exercise price and the spot price, which is equivalent to borrowing money from the issuer?

-

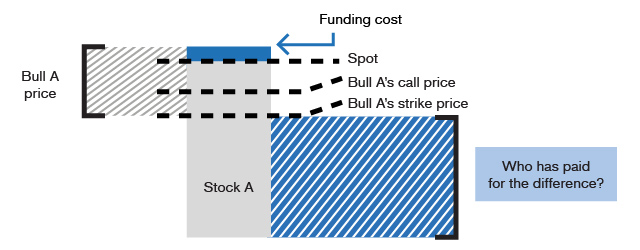

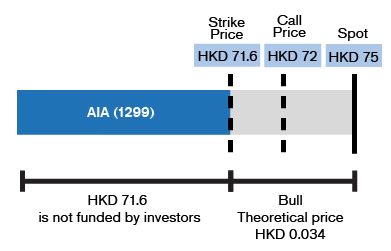

“Borrowing margin” from the issuer through bulls?In Guide for Beginners.How is the CBBC Price Determined?, we have explained that the value of a CBBC is equivalent to the difference between the spot price and exercise price plus a little funding cost. In other words, the investor only pays a small amount of money to deploy the underlying asset having a much higher price, which is also the leverage relationship that has been emphasized in Guide for Beginners.On the other hand, has it ever occurred to you that, who pays for the rest since the investor pays only a fraction of the price of the entire asset? Take a look at the following example:Say AIA's price is $75 and the call price, exercise price, entitlement ratio and theoretical price of a bull is $72, $71.6, 100:1 and $0.034,

After taking into account the entitlement ratio factor, the investor actually pays only $3.4 plus funding cost to deploy the underlying asset having a price of $75, and the $71.6 not paid by the investor is actually borne by the issuer. If AIA's price rises and the intrinsic value of the bull increases, with the entitlement ratio factor, the investor can also earn profits similar to those available in purchase of the underlying asset. The whole process, in principle, is similar to the investor's “borrowing margin” to buy assets.

After taking into account the entitlement ratio factor, the investor actually pays only $3.4 plus funding cost to deploy the underlying asset having a price of $75, and the $71.6 not paid by the investor is actually borne by the issuer. If AIA's price rises and the intrinsic value of the bull increases, with the entitlement ratio factor, the investor can also earn profits similar to those available in purchase of the underlying asset. The whole process, in principle, is similar to the investor's “borrowing margin” to buy assets. -

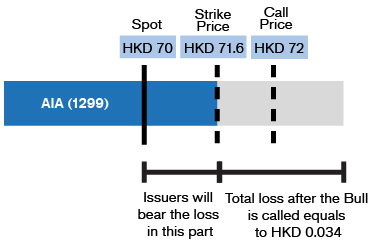

Mandatory stop loss, and the issuer's “sharing of loss”When the price of the underlying asset rises, the bull will benefit from the increase in the intrinsic value and the investor will make a profit; on the contrary, when the price of the underlying asset falls, the intrinsic value of the bull will decrease and the investor will record a loss. In extreme cases, however, investors' losses can be limited to a certain extent.Take the above AIA bull as an example. After an investor buys a bull when AIA's price is $75, AIA's price gaps down to $70. The bull has been called back due to its falling below the call price and exercise price. Since the largest loss of a CBBC is limited to the entire principal, the holder will incur a loss of $0.034 for each CBBC.

If the investor has purchased the underlying asset instead, when AIA's price falls from $75 to $70, there will be a loss of $5; however, through the deployment of bull, after taking into account the entitlement ratio, the investor actually only incurs a loss of $3.4. Where is the remaining $1.6 loss? In fact, the loss is “shared” by the issuer. We can say that the feature that the maximum loss of a CBBC is limited to the entire principal, this is equivalent to a mandatory stop loss mechanism, pursuant to which the additional decrease below the exercise price will be borne by the issuer.

If the investor has purchased the underlying asset instead, when AIA's price falls from $75 to $70, there will be a loss of $5; however, through the deployment of bull, after taking into account the entitlement ratio, the investor actually only incurs a loss of $3.4. Where is the remaining $1.6 loss? In fact, the loss is “shared” by the issuer. We can say that the feature that the maximum loss of a CBBC is limited to the entire principal, this is equivalent to a mandatory stop loss mechanism, pursuant to which the additional decrease below the exercise price will be borne by the issuer. -

Relative financing ratio / margin ratioInvestors who once borrowed “margin” should know that under the operation of general brokers, investors need to pay a certain ratio of margin before brokers provide a certain amount of credit based on the underlying assets to be deployed. The lending rate is known as the “margin ratio” in the industry.For large blue chips such as TENCENT (0700), HSBC HOLDINGS (0005) and CHINA MOBILE (0941), the margin ratio can reach 70%. However, for stocks that have a volatile trend or a light trading, such as gambling stocks GALAXY ENT (0027) and SANDS CHINA LTD (1928), the margin ratio will decrease accordingly and most brokers can only offer a margin ratio of approximately 50% to 60%.Having understood buying bulls is very similar to “borrowing margin” in nature, investors may wonder what the margin ratio is in buying bulls. According to the CBBC terms, a “relative financing ratio” comparable to the margin ratio can be calculated using the following formula:Relative financing ratio = 1 -CBBC price × entitlement ratio

Price of underlying assetsAfter calculation, it is not difficult to find that the relative financing ratio of a CBBC is generally higher than that of brokers, which means that investors need to pay less principal.For example, the relative financing ratio of TENCENT (0700) Bulls with a close-to-medium call level is generally as high as 85% or more, which is higher than that provided by brokers (70%). For the bulls of mobile device stocks like SUNNY OPTICAL (2382), the relative financing ratio is also as high as 70% or more, which is also higher than the margin ratio of approximately 50% to 60% generally provided by brokers.In addition to a lower cost, another advantage of CBBCs over margin financing is that no margin call is required. Thus, the risk may be relatively lower. On the other hand, if investors intend a pessimistic deployment, buying stock bears is also more convenient than a short-selling through brokers, and the daily funding cost deduction is also theoretically lower than the borrowing rate.In order to facilitate investors to compare the relative financing ratio of a CBBC and the margin ratio, the relative financing ratios of Credit Suisse CBBCs within each call range have been calculated in the Single Stock CBBCs Outstanding Distribution Chart on this website, giving investors more flexibility in controlling deployment costs.

Consolidate your memory immediately!

1. The theoretical value of a bull is the difference between the spot price and call price, and buying bulls is similar to “margin” in nature

2. When the underlying asset's price gaps down below the bull's exercise price, the investor will lose his entire principal

3. You can find out which deployment’s cost is lower by comparing the relative financing ratio and the margin ratio

2. When the underlying asset's price gaps down below the bull's exercise price, the investor will lose his entire principal

3. You can find out which deployment’s cost is lower by comparing the relative financing ratio and the margin ratio

Which of the above is correct?

When the underlying asset’s price rises, the investor may make a profit but he is afraid of missing the chance of a further rise?

Locking in Profit

Hedging against Risks

Volatility of Underlying Asset Affects the Selection of a CBBC

Complementation of a CBBC's Outstanding Quantity and Money Flow

Correct!

The theoretical value of a bull should be the difference between the spot price and exercise price, which is also the deployment cost an investor needs to pay.

Wrong!

The theoretical value of a bull should be the difference between the spot price and exercise price, which is also the deployment cost an investor needs to pay.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.