-

1. Everyone is talking about the Nasdaq Index, does everyone know what it really is?

"Don’t pretend to be an expert if you only know a little about it, isn't it about tech stocks, new economy stocks? Actually it is about much more…"

The Nasdaq Index, its full name is the Nasdaq Composite Index which consists of stocks that are listed on NASDAQ in the US. It has always been the case that most technology companies and biotechnology companies choose to list on the Nasdaq stock market, making it the indicator for tracking the trends of American technology companies.

In order to distinguish technology stocks from traditional financial stocks, the index company has further classified Nasdaq Index into:

1. Nasdaq-100 Index; and

2. Nasdaq Financial 100 Index

Nasdaq-100 Index has selected 100 larger and more representative companies from the industrial, technology, telecommunication, biotechnology, medical care, transportation, media and service sectors etc. as its component stocks. Stocks of large capitalization and size increase the representativeness of Nasdaq-100 Index, so many investment products have been created based on this index.

-

2. How large are the component stocks of Nasdaq-100 Index? How representative are they?

Most stocks with the largest weightings that make up the Nasdaq-100 Index are those of household names.

Apple is currently the largest weighing, I believe you or your friends must have one or two of their products, such as mobile phones, tablets, etc. And then there are ecommerce stock like Amazon, software producer MSN; the other top ten stocks include social network website Facebook, Alphabet (the parent company of Google), electric vehicle maker Tesla, semiconductor producer Nvida, software company Adobe as well as streaming entertainment platform Netflix*. The 10 largest stocks already make up an approximate weighting of 56.6% of the Index.**

-

3. Accurate prediction of the trend of Nasdaq Index but without a US stock account or enough capital, does it mean I can’t seize opportunities to capture profits from Nasdaq index movements?

Of course not, on the Hong Kong stock market, in fact there are investment products linked to Nasdaq Index. Even if you don’t have US stock accounts, you can still seize investment opportunities of new economy stocks in the US.

If you don’t have enough capital, you may wonder if there is any leveraged product which offer unlimited profit potential while restricting the possible loss low. Nasdaq-100 futures is one of the choices, but you need to have a futures account for it; and those warrants linked to Nasdaq-100 Index listed in Hong Kong are another leveraged product choice to use for either optimistic or pessimistic outlook.

-

4. Futures and warrants are both leveraged products, but what are their differences?

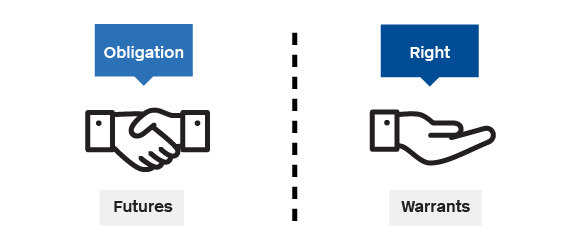

Futures and warrants are instruments to bet on future price trends of assets. Their differences between the two are that futures is an obligation, while warrant is a right.

Before trading futures, first you need to have a futures account and pay a certain margin deposit. Let say, after an investor has bought or sold a Nasdaq-100 futures contract, the trend of Nasdaq-100 Index is not in line with his expectation, after the index reaches a particular margin deposit maintenance level, the investor has the obligation to make additional deposit, therefore you have to cover this “extra losses” induced by the required additional deposit, thus the total losses may exceed the initial amount you invested.

For warrants, as they are listed on the stock exchange, they have their stock codes. You can trade as long as you have a Hong Kong stock account, there is no need to open an extra account for this. If you have bought a Nasdaq Index warrant and its trend is different to your expectation, since you have a right to exercise it, so when the trend is going in the opposite direction, it means the warrant cannot be exercised, there is no need to make additional deposit, and the maximum loss is only the capital you invested in the first place.

"Futures …… investors have the obligation to make additional margin deposit, which means there is the possibility of extra losses"

"As for warrants …… there is no need to make additional deposit, the maximum loss is only the capital invested"

-

5. How are Nasdaq Index products traded in the Hong Kong stock market?

Since Nasdaq Index is an American index, there is time zone difference: when the Hong Kong stock market is open, the Nasdaq stock market is closed; yet time zone difference doesn't mean trading cannot be executed. The emergence of electronic trading enables investors to trade Nasdaq-100 futures listed on the Chicago Mercantile Exchange (CME) electronically outside trading hours of US market.

Since Nasdaq-100 futures can be traded during APAC stock market trading hours, which means those warrants linked to the Nasdaq Index have the basis for price movements during the Hong Kong stock market trading hours. The issuers carry out hedging via the futures market can therefore make quotations for Nasdaq Index warrants, offering investors an additional trading choice.

-

6. Using warrants to buy a US index in the Hong Kong stock market? Will warrant prices not moves in HK trading hour?

Of course not! Although the component stocks of Nasdaq-100 Index are listed in the US, what warrant prices will follow are the underlying futures contracts. As the popularity of new economy stocks increases, in recent years even during the APAC trading hours, if there are political or economic events affecting the stock market, or any announcements relating to large technology companies, Nasdaq-100 futures also have substantial volatility effect during the APAC trading hours, therefore investors can use these instruments in their portfolios before the US stock market opens.

As these instruments follow price movements, so how do they react accordingly? If you want to calculate the price movement sensitivity of a Nasdaq Index warrant, that means how many ticks Nasdaq-100 futures need to change for a warrant to move by one tick, you can check the quotation of Nasdaq-100 mini futures available in Chicago Mercantile Exchange (CME) website and insert the figures in the formula below:

[(Entitlement ratio ÷ delta)] ÷ USD/HKD exchange rate x minimum spread of the warrant

For example, if a Nasdaq call warrants’ entitlement ratio is 30000 to 1, delta ratio is 0.32. Assume USD/HKD rate is 7.75 and the minimum tick value of the warrant is HKD 0.001.

Approximate Nasdaq 100 Futures’ change for 1 tick price change of Warrants = 30000 ÷ 0.32 ÷ 7.75 x 0.001 = 12 pts

By the same token, if a Nasdaq put warrants’ entitlement ratio is 25000 to 1, delta ratio is 0.25. Assume USD/HKD rate is 7.75 and the minimum tick value of the warrant is HKD 0.001.

Approximate Nasdaq 100 Futures’ change for 1 tick price change of Warrants = 25000 ÷ 0.25 ÷ 7.75 x 0.001 = 12.9 pts