Guide for Beginners

-

The right to exercise at a designated price and time

A warrant is the right to buy or sell underlying assets, which may be indices, stocks, commodities, foreign currencies, etc., at a designated time and at a designated exercise price.

-

Providing options for both optimistic and pessimistic outlooks

Warrants include call warrants and put warrants, which are the rights to buy (call warrants) or sell (put warrants) underlying assets.

For investors, this means options for both the bullish and bearishoutlook. For example, if the investor is bullish on Tencent, he may invest in call warrants of Tencent; if the investor is bearish on HSBC, he may invest in put warrants of HSBC.

Let’s look at the impact of the price movements of underlying assets on call warrants and put warrants:

Price of underlying assets Call warrants Put warrants Theoretical price rises Theoretical price drops Remember!Bullish on t the market Call warrants

Bearish onthe market Put warrants

-

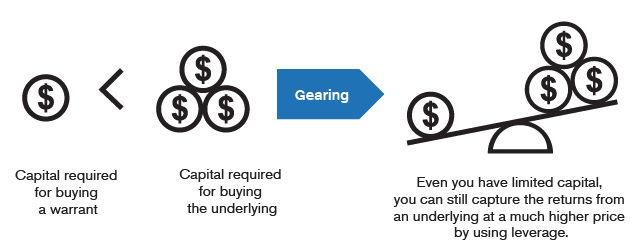

Warrants as a leverage product

Warrants are a type of leverage product. Investors can use a low warrant price (less money) to participate in the up and down of a stock with higher price (more money), in effect putting in a small investment for a bigger gain. However, this is a double-edged sword. If you correctly anticipate the movement direction and make the right decision, your potential profit will be amplified. However, if you make the wrong decision, your potential loss will also be amplified. 。

| Underlying price | Call warrants Theoretical price |

Put warrants Theoretical price |

|---|---|---|

| Rise | Rise | Drop |

| Drop | Drop |

|