Guide for Beginners

-

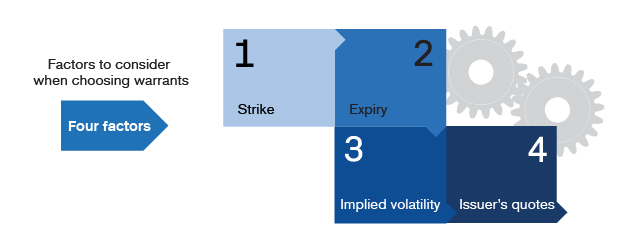

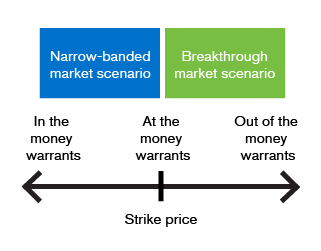

Selection of exercise price

Assuming other factors remain unchanged, a more out-of-the-money warrant will have a higher effective gearing. Therefore, aggressive investors tend to select out-of-the-money warrants, while conservative investors prefer at-the-money or in-the-money warrants.

Certain market conditions will also affect the out-of-the-money range adopted by the investors when selecting warrants. Under breakthrough market conditions, to capture the short-term fluctuations in the underlying assets, investors may select out-of-the-money warrants to amplify the fluctuations in the underlying assets; under ranging market conditions, investors may use at-the-money or in-the-money warrants to reduce the holding risk.

-

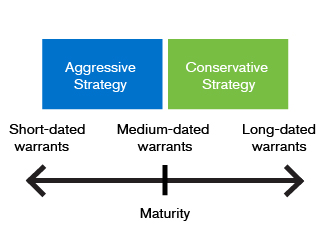

Selection of expiry date

Assuming all other factors remaining unchanged, products with shorter durations have less time for the price of the underlying assets to become in-the-money, so the risk will be higher; products with longer durations have more time for the price of the underlying assets to become in-the-money, so the risk will be lower.

Therefore, aggressive investors tend to select short-term warrants, while conservative investors prefer medium- and long-term warrants. Note that warrants suffer from time decay. The closer it is to the expiry date, the larger the daily decay will be.

-

Comparison of implied volatility

Warrants with similar terms may still have different prices, and one reason is that their implied volatility may be different. Products with higher implied volatility have a higher warrant price.

Investors generally want to reduce their entry cost, but does this mean that products with lower implied volatility are more worthy of investment? The answer is “No”.

In fact, the stability of a warrant’s implied volatility is more important than a low implied volatility. If the implied volatility has big rises and falls, the holding risk will be increased. Investors should refer to the implied volatility levels of the underlying product over a period of time before investment. Of course, if the market has large fluctuations, the implied volatility of the warrant will be unavoidably affected.

-

Observe the quotes of the warrant issuer

Issuers provide initial orders of warrants to investors for investment. Whether the warrant issuer provides quotes actively and the difference between the bid price and ask price will affect the trading cost for investors.

The warrant issuer will offer a reasonable bid-ask spread according to the turnover of the underlying assets, the number of orders, hedging difficulty, and the movement sensitivity of the warrant. Investors may check warrants with similar terms in the market, compare the quotes from different warrant issuers, and select products with active and reasonable quotes.

Stable implied volatility can protect the stock price from drastic fluctuations.

Stable implied volatility can protect the stock price from drastic fluctuations.