Guide for Beginners

-

Factors that affect the warrant price

Many factors affect the warrant price, with the three key ones being the price of the underlying assets, the time decay, and changes in implied volatility.

A warrant’s effective gearing displayed on the ticker is only a reference number calculated with a formula. In fact, this value only reflects the theoretical impact of the price of the underlying assets on the warrant price, without taking into account the influence of time decay and changes in implied volatility.

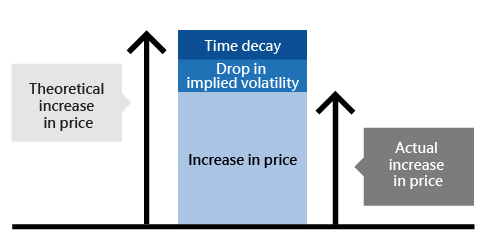

For example, say the effective gearing of a call warrant is 5x. When the price of the underlying assets increases by 1%, the theoretical increase in the warrant price is 5%. However, the daily time decay of the warrant is 0.5%, and the implied volatility drops on that day, which results in a decline of the warrant price by 1.5%.Therefore, the actual increase in the warrant is only 3%. This does not mean that the product failed to increase at the same rate, but only that the effective gearing cannot reflect any other factors than the change in the price of the underlying assets.

-

Under ranging market conditions...

Warrant prices in general do not increase at the same rate under ranging market conditions. Why is that so?

When market volatility is reduced:

1. The price of the underlying assets does not fluctuate much.

2. The implied volatility faces downward pressure.A slight increase in the price of the underlying assets provides a limited theoretical increase to the warrant price of a call warrant, but a drop in implied volatility will have a negative impact on the warrant price, on top of the downward pressures of time decay. If the theoretical increase in the warrant price is insufficient to offset the influence of the drop in implied volatility and time decay, a situation in which the warrant price drops while the price of the underlying assets rises may occur.