Guide for the More Experienced

-

Reasons for locking in profit

In addition to directional buying (buying on the upside or buying on the downside), warrants can also increase flexibility when an investor is placing assets and configuring investment portfolios.

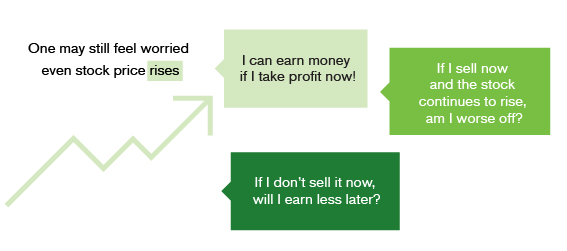

For example, when the price of the stocks held by an investor rises, he may think the following:

1. He may want to lock in the profit, but he is afraid that if he sells too early, he will miss subsequent potential rises.

2. He may want to wait for more rises of the stock price, but he is afraid that if he sells too late, the stock price will drop.Warrants can come into its own at this time. The investor may first sell his stocks to make a profit, and then buy some call warrants at the right proportion after having locked in his profit. The idea for the whole setup is that, if the stock price continues to rise, since the call warrant has leverage, the investor will not miss out on the rise; if the stock price subsequently drops, because the warrant cost is low, the maximum loss is limited to the principal. Besides, profit has already been locked in for the stocks, further reducing the potential loss.

-

Methods for locking in profit

Warrants allow investors to first lock in the profits under a stock price rise, and then, for a low capital outlay, hedge for potential rises of the underlying assets. The biggest question an investor has is, how many units of warrants does he need to buy to compensate for the underlying assets sold? It depends on how many shares you want to lock in a profit for. The formula is as follows:

The number of units of warrants to be purchased =number of underlying stocks x entitlement ratio of the warrant

deltaFor example, say an investor holds 2000 Ping An Insurance shares. He wants to capture subsequent potential rises of Ping An. Using a 10:1 Ping An call warrant with the delta of 25%, the number of units of the warrant he needs to buy is:

2,000 x 10

0.25= 80,000 unitsThe cost of buying 80,000 units of Ping An call warrant is definitely lower than that of 2,000 Ping An shares. Therefore, the investor can benefit from the trend of the underlying assets at a low cost. When the price of the underlying assets rises, the investor can profit from the warrant; if the price of the underlying assets drops, because the maximum loss under the warrants is merely the principal, the maximum loss of the investor is limited.

= number of underlying stocks x entitlement ratio of the warrant÷ delta

= 300 x 50 ÷ 0.3

= 50,000 units

= number of underlying stocks x entitlement ratio of the warrant÷ delta

= 300 x 50 ÷ 0.3

= 50,000 units