Guide for the More Experienced

-

What is premium?

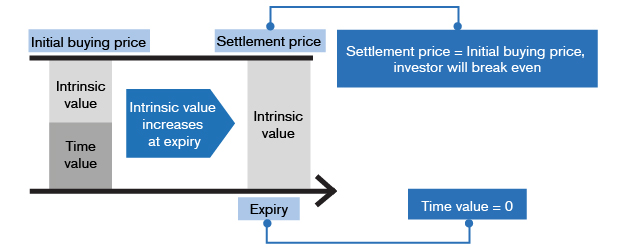

Each product has an intrinsic value and a time value. When the product matures, the time value becomes 0, so only an in-the-money warrant has a value. The premium in warrant terms is calculated based on the warrant price at this time, that is, how much does the price of the underlying assets need to increase or decrease to enable you to break even if you purchase the product at this time and hold it till expiry.

Because only in-the-money warrants have a value upon expiry, the more out-of-the-money a warrant is, the higher its premium, because the price of the underlying assets need to increase or decrease more sharply in order to obtain enough intrinsic value to offset the time decay within that period.

Many investors prefer products with a low premium. However, low premium merely means that the warrant is easier to reach the break-even point. At--the-money, in-the-money or short-term warrants generally have lower premiums, but one needs to be aware that other terms may mean that these warrants are not suitable for the investor.

“Only an in the money warrant will be settled with a cash value. Therefore, an OTM warrants’ premium will be higher.”

-

Low premium = worth buying?

There is a lot of misunderstanding about premium. One is to treat the premium as the indicator for how cheap or expensive the warrant is, or even claiming that warrants with low premiums are “most worth buying”. However, this belief is wrong.

The premium depends to a large extent on how out-of-the-money a warrant is, and its duration. For a warrant which is deeply out-of-the-money, because the price of the underlying assets need to change more in order to break even upon expiry, its premium will be high. A long-term warrant has more time value, so its premium will also generally be high. In fact, it is meaningless to compare the premium of warrants with different terms. Because premium is calculated based on the warrant price, it only makes sense to compare the premium of warrants with the same terms.

In addition, remember that premium is defined as how much the price of the underlying assets needs to increase or decrease to break even at the warrant’s expiry. Because most warrant investors do not hold their warrants to expiry, the premium is merely for reference.