Guide for the More Experienced

-

When the implied volatility changes by 1%...

The rise or fall of implied volatility will impact the warrant price, which has already been explained in the Guide for Beginners However, what is the degree of impact?

This depends on the warrant’s sensitivity to implied volatility, for which the academic term is “Vega”. “Vega” is how much impact will there be on the warrant price when the implied volatility changes by 1%. Professional quotation systems (such as Bloomberg) will use a number to indicate Vega. If the Vega of a warrant is 0.006, it means that when the implied volatility drops by 1%, the warrant price will theoretically drop by $0.006.

To better reflect the impact on the warrant price, the sensitivity to implied volatility will be displayed in percentages on the website of a warrant issuer. For instance, on the website of Credit Suisse, if a warrant’s sensitivity to implied volatility is displayed as 5%, it means that when the implied volatility drops by 1%, the warrant price will theoretically drop by 5%.

“Sensitivity to change in implied volatility is called "Vega" ”

-

The sensitivity varies with each warrant

This is because different stocks have different volatilities. For example, the volatility of HSBC (0005) is traditionally low, so the implied volatility of its warrants is low. When the implied volatility changes by 1%, because of the small base value of the implied volatility, it will have a large-percentage impact on the warrant price.

On the contrary, Galaxy Entertainment (0027) traditionally has high volatility, which means that the implied volatility of its warrants is high. When the implied volatility changes by 1%, it will conversely have a small-percentage impact on the warrant price.

It is for this precise reason that warrants with different underlying assets will have noticeably different sensitivities to implied volatility, even if they are out-of-the-money to the same extent, and have the same expiry dates. In fact, it is meaningless to compare the implied volatility of warrants with different underlying assets.

-

The relationship between sensitivity and terms

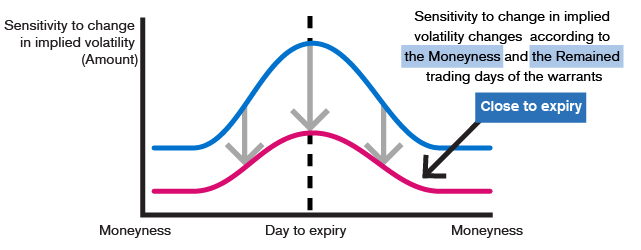

Even warrants with the same underlying assets will have different sensitivities to implied volatility if they have different terms.

Say two Tencent warrants have the same expiry dates. When the implied volatility changes by 1%, the price of the out-of-the-money warrant will have little change (in terms of monetary amount), while the price of the at-the-money warrant will be subject to a larger impact (in terms of monetary amount).

However, when shown in percentages, because the out-of-the-money warrant has a lower price while the at-the-money warrant has a higher price, the percentage impact on warrant price will also be different.

Taking the two Tencent call warrants with the same duration as an example:

1. say the price of the out-of-the-money warrant is $0.08;the impact on the price of the out-of-the-money warrant will be $0.005;2. say the price of the at-the-money warrant is $0.200;the impact on the price of the at-the-money warrant will be $0.009;when the implied volatility drops by 1%,In monetary terms, the at-the-money warrant is more sensitive to implied volatility.

However, in percentage terms, the sensitivity of the out-of-the-money warrant is 6.25%, while that of the at-the-money warrant is 4.5%, so their sensitivities are reversed.In addition, if two warrants are out-of-the-money to the same extent, the one with the longer duration will have a higher sensitivity to implied volatility in monetary terms, with the sensitivity falling as it gets closer to its expiry date. This is because if the implied volatility is increased, the long-term warrant will have more chance to achieve “at-the-money” than the short-term warrant. However, because the long-term warrant has a higher price, its implied volatility sensitivity may be lower than that of the short-term warrant if expressed in percentage terms.