Guide for the More Experienced

-

Sensitivity to interest rate changes

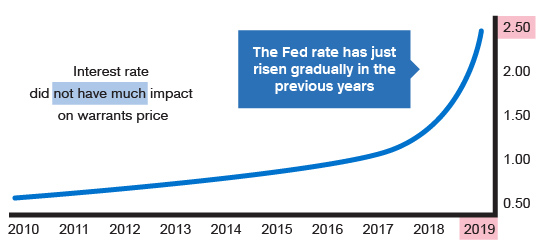

The FED had implemented quantitative easing for years since the financial crisis. Interest rates only started to increase steadily since 2015. However, the market is still in a low-interest environment. For warrants, interest rate changes will also impact the warrant price.

The academic name for sensitivity to interest rate changes is "Rho".

The Rho of call warrants

is a positive numberThe Rho of put warrants

is a negative numberbecause when interest rate increases, the cost of borrowing also increases, the capital outlay for selling call warrants will increase, so the price of call warrants will also rise.because when interest rate increases, the capital obtained from selling stocks can generate more interest, so the capital outlay for selling put warrants drops, therefore the price of put warrants will fall.The change directions are different between call warrants and put warrants.

It is worth mentioning that the Rho of the warrants listed in Hong Kong tracks the interest rate of Hong Kong. If Hong Kong does not follow the interest rate increases or decreases made by the FED, warrant prices will not be affected. -

Impact of interest rates on warrant price

Because interest rates seldom change significantly in a short space of time, interest rates actually only have a slight impact on warrant prices.

For example, interest rates generally adjust in multiples of 0.25%. For the half-year warrants generally taken up by investors, the actual impact of a 0.25% increase in interest rate is merely 0.125%.

Assuming that:

The stock price of HSBC (0005) is $65.the actual impact on the underlying asset is only $0.08 (or, 1.6 ticks).If interest rate changes by 0.125%On the other hand, for lower-priced stocks, such as

CCB (0939),

say its stock price is $6.5,the actual impact on the underlying asset does not even reach 1 tick. When the relevant change is then extended to the warrant, the influence is naturally insignificant.when interest rate changes by 0.125%

| Interest rate | Call warrants’ Theoretical price |

Put warrants Theoretical price |

|---|---|---|

| Rise | Rise |

|

| Drop | Drop | Rise |