Guide for the More Experienced

-

When the ex-dividend date is in line with expectations

A stable dividend policy is one of the key reasons for investors to select particular stocks. By being “stable”, it refers to stable ex-dividend dates as well as stable dividend amounts.

Stocks will be subject to an ex-dividend event after a company declares a dividend distribution. Similarly, when a warrant issuer issues the warrant, the ex-dividend factor will have been reflected in the warrant price based on the dividend payment history and the expiry date of the product. If the ex-dividend date is in line with expectations, in theory, the warrant price will not be affected.

-

Ex-dividend date brought forward or postponed

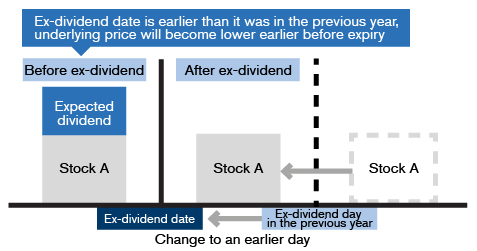

If the company changes its dividend policy, such as bringing forward or postponing the ex-dividend date, it is possible that the warrant price will be affected.

If the company brings forward the ex-dividend date, for products which would have expired before the old ex-dividend date, because the ex-dividend date is now brought forward to before the expiry date, the price of the underlying assets will be reduced ahead of schedule,

so a call warrant will be subject to a negative impact, while a put warrant will benefit.

An actual example is when, in 2018, the mainland insurer Ping An Insurance (2318) brought forward the ex-dividend date for the final dividend from early July to early June 2017. As a result, the prices of call warrants which expired at the end of June dropped due to the ex-dividend event ahead of schedule, while the prices of put warrants increased. If a company postpones the ex-dividend event to after the expiry date of a warrant, the price of the underlying assets will only be reduced after the expiry date. As result, a call warrant will be positively affected, while a put warrant will drop.

Note that even when a company brings forward or postpones the dividend distribution, if the expiry date of the warrant comes after the ex-dividend dates before and after the change, in theory, the warrant price will not be affected.