-

1. Nasdaq Index warrants talk about these! What are the factors affecting their prices?

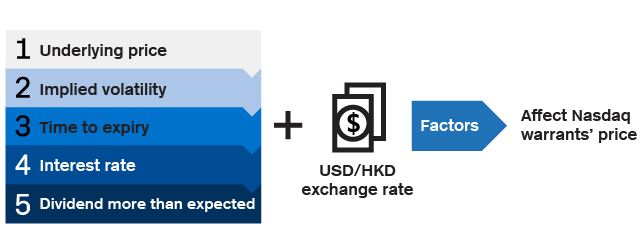

Like other warrants, Nasdaq Index warrants will be affected by several different factors: the 5 main factors which are mentioned in Guide for Beginners: 《Guide for Beginners: Factors that Affect the Warrant Price (I)》they are the prices of the underlying assets (here they refer to the changes of Nasdaq-100 futures), implied volatility, interest rate and dividend yield, all affecting the price trend of a Nasdaq Index warrant.

However there is one thing that Nasdaq Index warrants differ from other warrants linked to Hong Kong stocks or Hong Kong indices, since Nasdaq Index warrants track the assets denominated in USD, so changes in the USD/HKD exchange rate will also affect the prices of the Nasdaq Index warrants. But there is the pegged exchange rate between USD and HKD, so this change is small, yet you should bear this in mind.

-

2. In fact what makes investors interested in Nasdaq Index warrants? It’s the leverage! So how high is the leverage?

What Nasdaq-100 Index covers are those technology companies with extremely high volatility, since the volatility is not low, the level of implied volatility of the underlying option will not be very low.

Nasdaq-100 futures which need to bear the risk of additional margin deposit have a leverage of about 14 times, the leverage of warrants is a bit lower, and normally the effective leverage is around 5 to 7 times. Investors also need to bear in mind that the actual leverage is only a reference value, warrant prices are also affected by factors such as time decay, changes in implied volatility and exchange rates etc.

-

3. Everything has an expiry date, how to settle when a Nasdaq Index warrant expires?

Since Nasdaq Index warrants are also warrants, they have expiry dates. Settlement will be made after the expiry date.

The settlement reference value of a Nasdaq Index warrant is the settlement price of the futures contract on the expiry date of that month. To give you an example, a Nasdaq Index warrant with an expiry of 19 March 2021, its settlement price will use the settlement price of a Nasdaq-100 futures expiring on 19 March 2021 (US time).

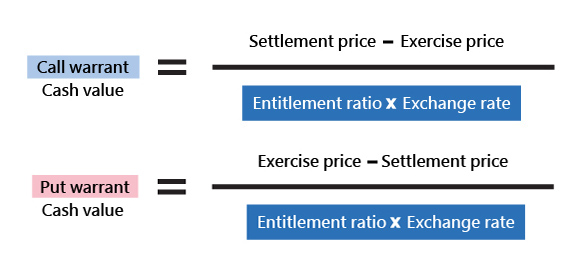

Like other warrants, an in-the-money warrant will have cash value after the expiry date, the value of an out-of-the-money warrant is 0 after the expiry date. The settlement formulas of warrants are as below:

For example, the exercise price of a particular Nasdaq Index warrant is 12,500, the entitlement ratio is 25,000:1, and the expiry date is 19 March. On the expiry date, the settlement price of Nasdaq-100 futures is 13,000, the USD/HKD exchange rate is 7.75.

Cash value after settlement = ( 13,000 – 12,500 ) ÷ 25,000 x 7.75 = $0.155