Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for Beginners

The price of the underlying assets is not the only factor that affects the warrant price...

-

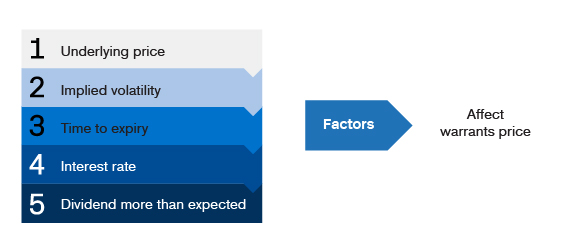

Which factors affect the warrant price?

Many factors affect the warrant price, with the three key ones being the price of the underlying assets, changes in implied volatility, and the time decay.

In addition, changes in the interest rate, dividend distributions, the outstanding quantity, bid-ask spread, and the market demand-supply relationship of the products, will also affect the warrant price.

-

How would the warrant price be affected?

Different factors affect the price movement of call warrants and put warrants differently, summarized as follows:

Price of call warrants Price of put warrants When the price of underlying assets increases Theoretical price rises Theoretical price drops When the implied volatility increases Theoretical price rises Theoretical price rises When it gets closer to the expiry date Theoretical price drops Theoretical price drops When the interest rate increases Theoretical price rises Theoretical price drops When the dividend distribution is more than expected Theoretical price drops Theoretical price rises

Consolidate your memory immediately!

If the price of the underlying assets and implied volatility remain unchanged, one week later, the theoretical price of the warrant will

Move quickly? Move slowly? Do warrant prices also move quickly or slowly?

Factors that Affect the Warrant Price (II)

Correct!

Even if the price of the underlying assets and implied volatility remain unchanged, the warrant will experience time decay during the period, causing a decline in the warrant price.

Wrong!

Even if the price of the underlying assets and implied volatility remain unchanged, the warrant will experience time decay during the period, causing a decline in the warrant price.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.