Guide for Beginners

-

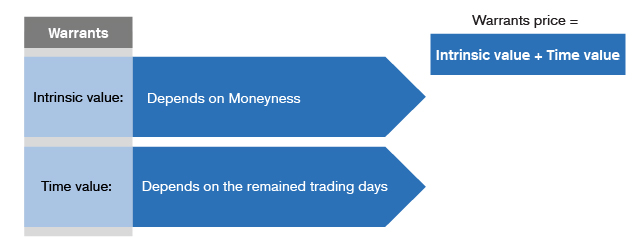

Intrinsic value

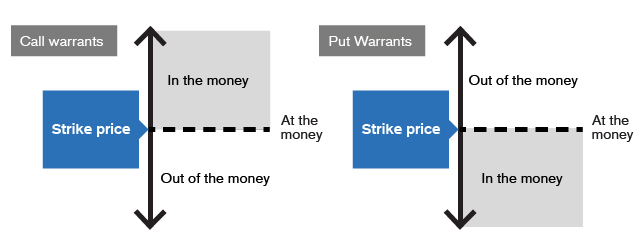

To explain intrinsic value, we need to first look at the concepts of “out-of-the-money” and “in-the-money”. For a call warrant, if the spot price is lower than the exercise price, it is called “out-of-the-money”; when the spot price is higher than the exercise price, it is called “in-the-money”. On the contrary, for a put warrant, if the spot price is higher than the exercise price, it is called “out-of-the-money”; when the spot price is lower than the exercise price, it is called “in-the-money”. For both types of warrants, if the spot price is equal to the exercise price, they are called “at-the-money”.

Let’s say that the spot price of HSBC isThe exercise price of an HSBC call warrant is $70, so it is "in-the-money".The exercise price of an HSBC put warrant is $70, so it is "out-of-the-money".

Let’s say that the spot price of HSBC isThe exercise price of an HSBC call warrant is $70, so it is "in-the-money".The exercise price of an HSBC put warrant is $70, so it is "out-of-the-money".An “out-of-the-money” warrant does not have an intrinsic value. When a warrant changes from “out-of-the-money” to “in-the-money”, the value derived from the difference between the spot price and the exercise price is the intrinsic value.

-

Time value

Each warrant has its own expiry date. When the product has not yet reached its expiry date, there is still the possibility of the price of the underlying assets to change and for investors to gain more profit upon expiry. Time value is the price for this opportunity.

A long-term warrant has more time value, while a short-term warrant has less time value. As the product gradually moves towards its expiry date, the time value will reduce each day, and the warrant price will be subject to time decay. The time value will reach zero upon the expiry of the warrant.

A Tencent call warrant with an exercise price of $350 is