Guide for Beginners

-

Price of the underlying assets

This is the key factor that affects the warrant price. Each warrant has its underlying assets, which may be indices, stocks, foreign currencies, commodities, etc. When the asset price changes, in theory, the warrant price will also change.

-

Exercise price

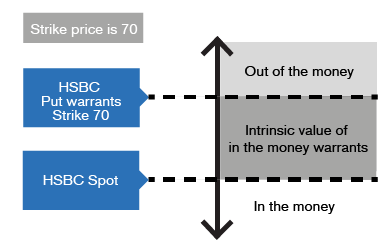

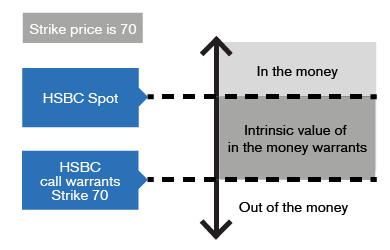

This is the price for buying (call warrant) or selling (put warrant) the underlying assets upon the expiry of the warrant.

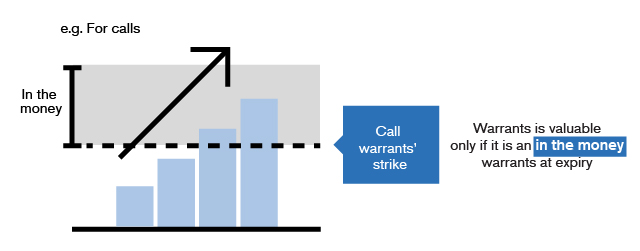

For investors, the choice of exercise price will affect the warrant’s hedging risk. Assuming other factors remain unchanged, the more out-of-the-money a warrant is, the higher its potential risk. In addition, the exercise price also affects the warrant’s value. The closer the exercise price is to the spot price of the underlying assets, the higher the warrant’s value will be. In-the-money warrants have an intrinsic value, which is the net positive value of the difference between the exercise price and the spot price of the underlying assets.

HSBCexercise price is $70