Guide for the More Experienced

-

What is bid-ask spread?

When a warrant issuer provides liquidity for its products, it needs to offer bid prices and ask prices. The difference between the maximum bid price and minimum ask price offered by the warrant issuer is the bid-ask spread. If an investor buys a warrant from the warrant issuer at an ask price, and then sells the warrant he holds at a bid price, the price difference between those two trades is the trading cost of the investor.

-

The best bid-ask spread

For investors, the narrower the bid-ask spread is, the lower the trading cost will be. Of course they would like to see warrant issuers offer orders with narrow spreads between them. However, in practice, not all products can maintain the narrowest bid-ask spreads, because factors such as the underlying assets’ liquidity, turnover, the sensitivity of the product and hedge difficulty will all affect the ability of the warrant issuer to offer narrow spreads.

The so-called “best bid-ask spread” is based on observations of whether the orders offered by a warrant issuer is reasonable based on the product’s sensitivity. We have already explained the calculation of warrant sensitivity in the Guide for Beginners. If a warrant has such a sensitivity that the warrant price will move by 2 ticks when the price of the underlying assets moves by 1 tick, its “best bid-ask spread” should also be 2 ticks. If the warrant issuer can offer a spread of 1 to 3 ticks for the product, that should be considered as a reasonable quote.

The bid-ask spread of warrants will expand or narrow according to market conditions during a trading session. If the price of the underlying assets rises or drops sharply within a short period of time, the orders of the underlying assets are insufficient to create a spread, a certain product has a big buy order or sell order within a short period of time, or the outstanding quantity is too high, the intraday spread will also be affected. Once the relevant situation stabilizes, the warrant issuer will gradually narrow the spread.

"In case if underlying moves 1 tick, the warrant’s theoretical price will move two ticks. Then, the warrant’s best spread equals to two ticks. If an issuer quotes at a spread between 1-3 ticks, this is reasonable."

-

Comparing the spread-based trading cost

When an investor buys a warrant at an ask price and then sell the warrant at a bid price, the difference between the two is the trading cost. Therefore, the lower the bid-ask spread is, the lower the trading cost will be.

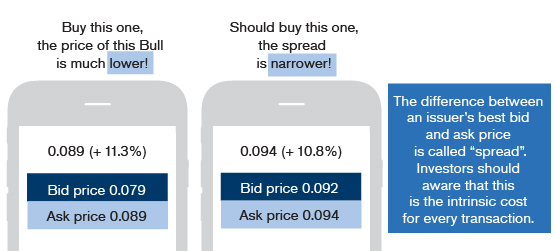

Let’s compare the following two products, assuming that they have the same terms, and the bid price and ask price are as follows:

Bid price Ask price Call warrant A 0.079 0.089 Call warrant B 0.092 0.094 Many investors may consider call warrant A “more worth buying” because it has a lower warrant price. However, in fact, assuming that the stock price and implied volatility remain unchanged, if the investor buys call warrant A at the price of $0.089, he can only sell the product at the price of $0.079 on the same day. The trading cost (the 10-tick bid-ask spread) equals to approximately 11% of the invested principal (0.010 ÷ 0.089 = 11.2%).

Although call warrant B has a higher warrant price, its bid-ask spread is only 2 ticks; therefore, the trading cost only accounts for about 2% of the principal (0.002 ÷ 0.094 = 2.1%). If the warrant issuer can maintain stable quotes, the trading cost to the investor will be lower.

| Bid price | Ask price | |

|---|---|---|

| Call warrant A | 0.123 | 0.125 |

| Call warrant B | 0.130 | 0.135 |