Guide for the More Experienced

-

Demand and supply relationship

Everything can get sold out, and warrants are no exception. When applying for issuing products at the stock exchange, the warrant issuer will specify in advance the number of units offered. Each warrant is in limited supply; once it’s all sold, no more will be available.

On the first day of the listing of the warrant, the issuer holds all the units, and the outstanding quantity will be 0. When the warrant issuer offers buy orders or sell orders for the product, investors will be able to participate in the trading. After the warrant issuer sells its product, it needs to upload the relevant information onto the website of the stock exchange on each trading day. The number of units of warrants held by investors in the market is the outstanding quantity.

The outstanding quantity is generally displayed as a percentage. For example, if the outstanding quantity of a warrant is 30%, it means that 30% of the total size issued has been sold by the warrant issuer and is being held by investors in the market.

"For example, if the outstanding quantity of a warrant is 30%, it means that 30% of the total size issued has been sold by the warrant issuer and is being held by investors in the market. "

-

Additional issues of warrant

When the outstanding quantity of a warrant increases to 50%, the warrant issuer may apply to the stock exchange for issuing additional warrants (that is, to increase the size of issue). The additional units of warrants will be listed on the third trading day after the application.

In the case of additional issues, because the size of issue has increased, even if investors hold the same number of units, the outstanding quantity percentage will be reduced. The warrant issuer will hold more units of warrants and be able to maintain orderly trading.

However, not all warrant issuers will have additional issues for warrants with high outstanding quantity, especially for warrants of inactive stocks which are difficult to hedge, and the supply of hedging instruments is limited. A warrant issuer will determine whether to carry out additional issues based on factors such as market demand and hedging difficulties.

-

Impact of high outstanding quantity

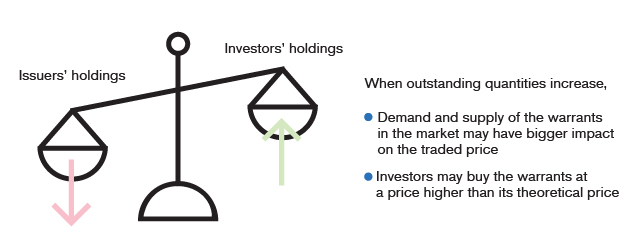

What is considered to be a high outstanding quantity? There is no standard measure in the market. Some investors believe that more than 50% is high, but some believe that it is not high unless it is above 70%. But what is more important is what impact a high outstanding quantity will have.

High outstanding quantity means that the majority of the units of warrants are already held by investors in the market, meaning the warrant issuer may not have enough quantity to satisfy orders. In this situation, the warrant price may become more sensitive to market demand and supply. In some extreme situations, if the outstanding quantity has risen to 100%, =the warrant issuer no longer has any holdings, it can only offer buy orders at the theoretical price. If other investors did not keep an eye on the quotes provided by the warrant issuer, they may purchase the warrant at a price far higher than the theoretical price from other investors, and thereby suffer loss.

Therefore, issuers generally advise investors to avoid products with high outstanding quantity. And investors should check the theoretical bid price offered by the warrant issuer on the ticker before they trade, so as to reduce the chance of buying at a non-theoretical price.