Guide for Beginners

-

What is gearing?

Gearing is the relationship between underlying assets and CBBC price. Tencent, valued at of hundreds of dollars’ performance can be imitated by a bull of only a few cents. This is the leverage of a bull.

Gearing’s definition, in simple terms, is the movement in the CBBC price when the price of the underlying asset changes by 1%, assuming other factors remain unchanged.

For example, when Tencent’s stock price rises by 1%, the price for a Tencent bull with an effective gearing of 20x will, in theory, rise by 20%; and the price for a Tencent bear with an effective gearing of 15x will, in theory, drop by 15%.

-

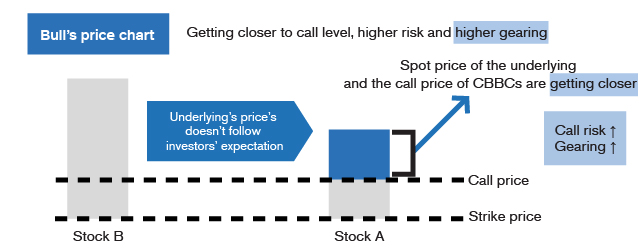

Change in gearing

As the saying goes, “the greater the risk, the higher the reward and the bigger the loss.” The leverage of a CBBC is not always the same. As gearing is related to the prices of both the underlying asset and the CBBC, it will rise or fall in the directions corresponding to the changes in the underlying asset price.

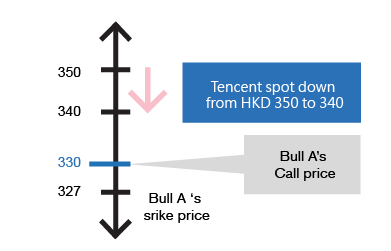

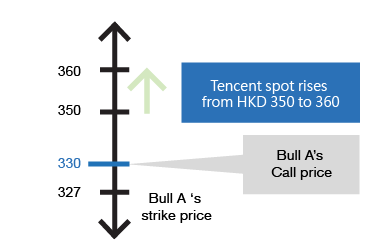

For example, for a Tencent Bull with a call price of $ 330, when the underlying price when Tencent rises from $350 to $360 in price, the difference between the spot price and call price becomes bigger; the risk of a call event falls; and the prices of both the underlying asset and the bull will rise. This, in turn, contributes to the decrease in the gearing of the bull.

when Tencent rises from $350 to $360 in price, the difference between the spot price and call price becomes bigger; the risk of a call event falls; and the prices of both the underlying asset and the bull will rise. This, in turn, contributes to the decrease in the gearing of the bull.