Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for Beginners

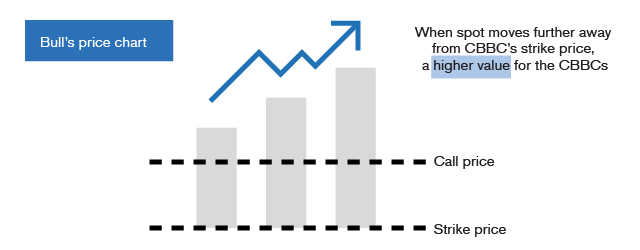

Want to raise the intrinsic value? The key is to enlarge the difference with the exercise price.

-

Call price

As mentioned in the Guide for Beginners: What is a CBBC?, CBBCs have a call feature. Once the underlying asset price reaches the call price of a CBBC, trading in the CBBC will cease. The CBBC will be called back immediately and settled. Methods of settlement will be explained below.

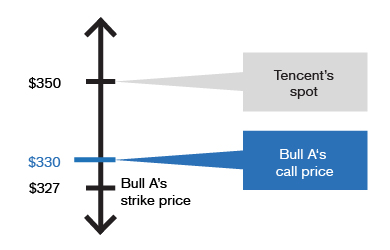

Bulls are products for optimistic outlooks. Their call prices are set below spot prices.

Bulls are products for optimistic outlooks. Their call prices are set below spot prices.

For instance, the spot price of Tencent is $350. A Tencent bull at a call level of $330 indicates that such bull will be called back when Tencent’s stock price drops to $330. Bears are products for pessimistic outlooks. Their call prices are set above spot prices.

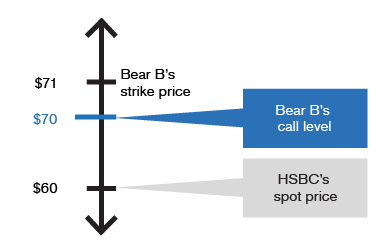

Bears are products for pessimistic outlooks. Their call prices are set above spot prices.

For instance, the spot price of HSBC is $60. A HSBC bear at a call level of $70 indicates that such bear will be called back when HSBC’s stock price rises to $70. -

Exercise price

Similar to the concept for a warrant, exercise price is the price at which purchases (in the case of bulls) or sales (in the case of bears) of underlying assets are made when the product expires. And as CBBCs are settled in cash, the exercise price can also be regarded as an indicator in calculating the product’s value, including the cash value upon expiry and the residual value after being called back.

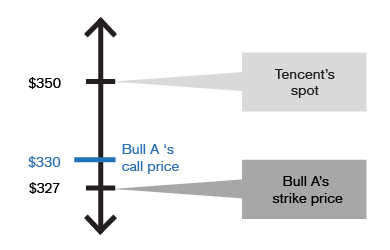

Exercise prices of bulls are set below call prices.

Exercise prices of bulls are set below call prices.

For instance, the spot price of Tencent is $350. For a Tencent bull with a call price of $330 and an exercise price of $327, its price will be the difference between $327 and $350 plus funding cost. Exercise prices of bears are set above call prices.

Exercise prices of bears are set above call prices.

If the spot price of HSBC is $60, for an HSBC bear with a call price of $70 and an exercise price of $71, its price will be the difference between $60 and $71 plus funding cost.

Consolidate your memory immediately!

For bulls, call prices are set below spot prices and exercise prices below call prices.

For bears, call prices are set above spot prices and exercise prices

call prices.

CBBCs close to expiry and not called back will become worthless?

Understanding CBBC Terms One by One

(2) Expiry Date

(3) Entitlement Ratio

(4) Gearing

Correct!

Bears are products for pessimistic outlooks. Their call prices are set above spot prices and exercise prices even above call prices.

Wrong!

Bears are products for pessimistic outlooks. Their call prices are set above spot prices and exercise prices even above call prices.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.