Leverage and sensitivity are two different concepts.

CBBCs may have similar sensitivities even though their leverages are different.

Hotline: + 852 2101 7888

E-mail: hk.warrants@credit-suisse.com

Guide for the More Experienced

The higher the leverage, the faster the movement? It's wrong!

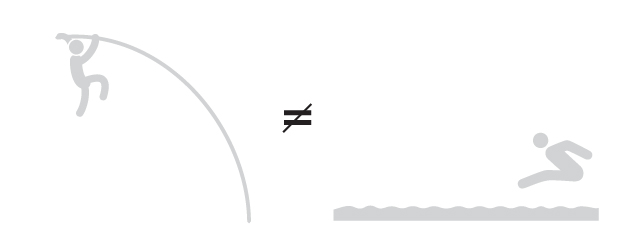

Just like the high jump and the long jump, they are totally different things!

Just like the high jump and the long jump, they are totally different things!

-

Leverage ≠ SensitivityWe once had an investor asking, why is the movement of the price of an HSI bull with a high leverage is similar to that of another bull with a much lower leverage? In fact, this situation is completely reasonable, because leverage and sensitivity are two completely different concepts.Let's review the explanation in Guide for Beginners: Understanding CBBC Terms One by One (IV) - Gearing.Gearing is the relationship between the underlying asset and the CBBC price, just like "high jump" in the picture; while sensitivity indicates how much the underlying asset needs to move by if the CBBC price is to move by 1 tick, just like "long jump" in the picture. Therefore, high leverage is not the same as high sensitivity.For example, if two HSI bulls have the same entitlement ratio of 10,000:1 and a price below $0.25, the call price of bull A is 26,800 points, and the call price of bull B is 26,500 points. Say the difference between the call price and exercise price for both bulls is 100 points, and the delta is 1.

HSI bulls A HSI bulls B Entitlement ratio 10,000:1 10,000:1 Price below $0.25 below $0.25 Difference between the call price and exercise price 100 points 100 points Delta 1 1 Call price 26,800 points 26,500 points Since bull A is closer to its call level and its price is lower, its leverage is naturally higher than bull B's. However, since the entitlement ratio and delta of the two are the same, the sensitivity of bull A and bull B is actually the same, that is, when the futures index moves by 10 points, their prices will move by 1 tick, which once again proves that leverage and sensitivity are two completely different concepts. -

Which one should I look at first, the leverage or the sensitivity?Since leverage and sensitivity are two completely different concepts, you may ask which one is more important in selecting a CBBC, the leverage or the sensitivity?This mainly depends on the investment strategy of the investor. The leverage of a CBBC generally reflects the product's risk of reaching a mandatory call event. Investors who are willing to take on a greater risk of a mandatory event can naturally enjoy a higher leverage. On the other hand, sensitivity depends on the minimum spread and entitlement ratio of the product, allowing investors to be more flexible in response to market volatility.Once again, using the HSI bull as an example,Aggressive investorswho prefer low cost and high leverage may choose a product that is closer to its call level and will naturally focus more on leverage.Conservative investorswant to reduce the risk of a mandatory call event and so are more interested in CBBCs with further call levels, and therefore will naturally pay attention to products with a lower leverage.When there is sharp rise or fall in market volatility, investors will pay more attention to sensitivity. When the volatility of HSI increases, investors may pay more attention to CBBCs with a low sensitivity in order to reduce the intraday change; when the market volatility is low, investors may focus more on CBBCs with a high sensitivity to increase the daily range of the products. High leverage and high sensitivity can coexist, and the sensitivity of low-leverage products will not necessarily get lower. Investors should balance between these two factors based on their risk tolerance.

Consolidate your memory immediately!

When assessing the leverage and sensitivity of a CBBC,

1. the sensitivity of a highly-leveraged CBBC is higher

2. the sensitivities of two CBBCs with different leverages may be the same

3. for bulls with the same call price but different entitlement ratios, their sensitivities will also be different

1. the sensitivity of a highly-leveraged CBBC is higher

2. the sensitivities of two CBBCs with different leverages may be the same

3. for bulls with the same call price but different entitlement ratios, their sensitivities will also be different

Which of the above is correct?

There is no dividend for the purchase of a CBBC but there is dividend distribution for the underlying asset. How to calculate?

Different Prices, Different Minimum Spreads

Dividend Amount and Ex-dividend Date are Different from Expectations

Comparison of Bid-ask Spreads

Correct!

Wrong!

Leverage and sensitivity are two different concepts.

CBBCs may have similar sensitivities even though their leverages are different.

CBBCs may have similar sensitivities even though their leverages are different.

Disclaimer :

DB Power Online Limited, "HKEX Information Services Limited, China Investment Information Services Limited, its holding companies and/or any subsidiaries of such holding companies", and/or its third party information providers endeavor to ensure the accuracy and reliability of the information provided but do not guarantee its accuracy or reliability and accept no liability (whether in tort or contract or otherwise) for any loss or damage arising from any inaccuracies or omissions.