Guide for Beginners

-

Observe gap volatility

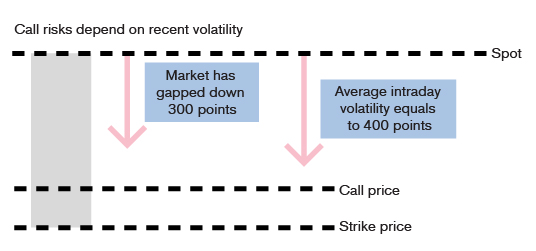

Investors worry most about products being called back when they deal in CBBCs, of which the hardest to avoid is having a gap opening immediately when trading starts when the spot price touches the call price. This is because if this happens, the product would have lapsed even before investors could stop the loss.

One way to measure the risk of a call event is to observe recent gap volatilities. In view of recent volatility levels, investors can pick CBBCs with a spread between the call price and spot price which is wider than recent gap volatilities.

For example, if a gapped drop of 400 or 500 points has occurred recently, investors may choose HSI bulls with a spread between the call price and spot price which exceeds 500 points to reduce the potential risk of a call event.

The biggest recent gap volatilities are set out on the page headed Guide for Selection of CBBCs in the context of HSI Volatility on this site for investors’ reference when they are selecting HSI CBBC call prices. Of course, past performance does not necessarily reflect future performance. Historical gap volatilities are for reference only. They do not imply that bigger gaps will not occur in the future. Investors should pick products with further call levels based on their own risk tolerances. -

Observe intraday volatility

The higher the price fluctuation in a stock, the higher the risk of the related CBBC being called back. Therefore, making reference to the volatility in underlying assets might help reduce the chance of the selected CBBC being called back.

For example, HSI underwent increasing fluctuation recently with intraday volatility once exceeding 500 points in a single day. If investors intend to reduce risks, they might pick a CBBC with a call level over 500 points from the spot level, so as to lower the chance of being called back within the day.

Average 5-day intraday volatilities for HSI and the biggest intraday volatilities for HSI in 10 days are set out on the page headed Guide for Selection of CBBCs in the context of HSI Volatility on this site for investors’ reference when they are selecting HSI CBBC call prices. Of course, past performance does not necessarily reflect future performance. Historical intraday volatilities are for reference only. They do not imply that future fluctuations will not widen up or narrow down. Investors should pick products with further or closer call levels based on their own risk tolerances.

2. This month saw the biggest gapped drop in HSI of over 400 points, indicating that HSI’s gapped drop in the following month will not exceed 400 points

3. Products with a call price far away from the spot price have a lower risk of being called back