Guide for Beginners

-

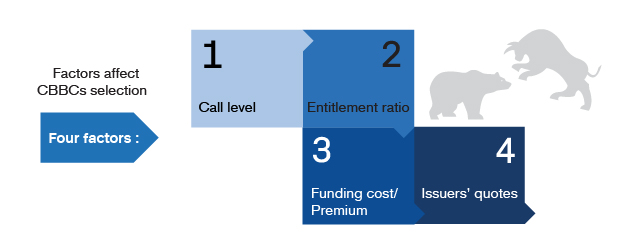

Selection of call price

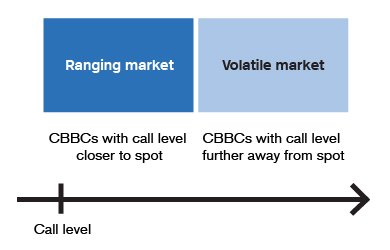

Assuming other factors remain unchanged, products with a call price closer to the spot price will have higher gearing as the risk of a call event is higher. Therefore, aggressive investors tend to choose CBBCs with a closer call level, while conservative investors prefer CBBCs with further call levels.

Certain market conditions may also influence the call levels that the investors might choose. In a ranging market, as there is little fluctuation, there is a lower risk for a call event; investors might pick CBBCs with closer call levels to raise gearing and magnify the stagnant underlying asset price. In a volatile market, investors might turn to CBBCs with further call levels because the chance of a call event is higher.

-

Selection of entitlement ratio

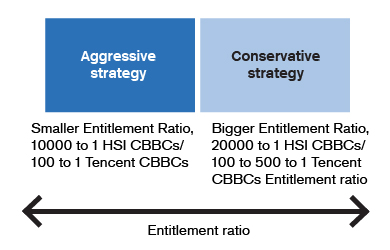

Assuming other factors remain unchanged, products with higher entitlement ratio usually have lower movement sensitivity. As explained in the section headed Guide for Beginners: Calculation of CBBC Price Movement, an HSI bull with an entitlement ratio of 10,000:1 moves faster than one with an entitlement ratio of 20,000:1, assuming they have the same minimum spread.

Consequently, aggressive investors tend to pick CBBCs with lower entitlement ratios, while conservative investors tend to consider products with higher entitlement ratio for lower movement sensitivity. Note that products with higher entitlement ratios typically come with lower face values and possibly lower entry cost per board lot, which makes it suitable for conservative investors.

-

Comparison on funding cost and premium

Investors generally wish to reduce entry cost and may therefore pick CBBCs with a lower funding cost or premium. Is this set in stone?

Generally, long-tenor CBBCs have higher funding costs than those with short tenor because the hedging cost involved is higher; stocks with higher volatility also have higher funding cost or premium as hedging is more difficult. Thus, it’s hard to make comparisons on their respective funding cost or premium.

Even if two CBBCs have similar terms, if they have different outstanding quantities, the product with a higher outstanding quantity might be lower in price as the issuer has already deducted certain funding costs as hedging cost. In this case, however, investors are exposed to other risks caused by the high outstanding quantity, so the product is not necessarily suitable for investment. In a word, although there is a need to compare funding cost or premium, these two factors are, in practice, more likely to be used as reference. -

Observe an issuer’s quotes

Issuers provide initial orders of CBBCs to investors for investment. Whether the issuer provides quotes actively and the difference between the bid price and ask price will affect the trading cost for investors.

Issuers will offer a reasonable bid-ask spreads according to the turnover of the underlying assets, the number of orders, hedging difficulty as well as the movement sensitivity of the CBBCs. Investors may check CBBCs with similar terms in the market, compare the quotes from different issuers, and select products with active and reasonable quotes.

If I want to reduce the movement sensitivity of a CBBC,