Guide for Beginners

-

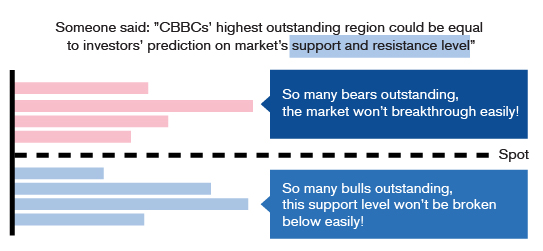

Highest outstanding level

The highest outstanding level of a CBBC refers to the call level with the highest invested amount deduced by adding up all the outstanding CBBCs for the same asset in the entire market based on reports uploaded to the exchange by issuers each day.

Take HSI CBBC outstanding chart as an example. Many investors view the highest outstanding level of a bull or a bear as the support level or resistance level in the market because the market obviously is confident that the index will neither rise above nor drop below the call level it buys in.

Then again, past performance does not necessarily reflect future performance. It happens from time to time that the highest outstanding level is exceeded. Therefore, the highest outstanding level is aimed at generalizing the positions held by investors in the market. Despite that it could serve as a reference for market trend predictions, it is not a certain indicator.

Additionally, changes in the highest outstanding level against the equivalent number of futures contracts for hedging purposes will also reflect investors’ orientation towards increasing or decreasing holdings, from which it is possible to estimate their view on the market going forward. -

Equivalent number of futures contracts for hedging purposes

Investors who pay attention to CBBC outstanding charts may find that issuers often use the concept “equivalent number of futures contracts for hedging purposes” as the standard for measuring the increase or decrease in highest outstanding levels. What is “equivalent number of futures contracts for hedging purposes”?

The figure stems from the different entitlement ratios of CBBCs in the market, such as 10,000:1, 12,000:1, 20,000:1, etc. Since outstanding quantities only show the number of CBBCs sold by issuers, the size of the position of a CBBC with a big entitlement ratio is not necessarily the same as that with a small one, even if they have the same call prices and outstanding quantities.

To better reflect reality, issuers take into account the outstanding quantity when they calculate the entitlement ratio, and then converts into the “equivalent number of futures contracts for hedging purposes”, so as to allow investors to compare on the same basis when they look at the highest outstanding levels.

Likewise, in respect of stock CBBCs, since CBBCs with the same underlying asset could still have different entitlement ratios, issuers convert the outstanding quantity into the “equivalent number of shares for hedging purposes” so as to provide the same comparable standard.

2. The highest outstanding level of an HSI bear represents that bearish investors hold the view that the chance of the market price rising above that level is relatively low.

3. Changes in the equivalent number of futures contracts in the context of high outstanding levels reflect the reallocation in positions.